The Bank of England (BOE) delivered a dose of tough love to the U.K. economy today, choosing to maintain interest rates at a lofty 5.25%.

The decision holds the key rate at a 16-year high, sending a clear signal that the central bank continues to worry more about elevated price pressures rather than how elevated interest rates are likely slowing economic activity in the U.K.

Read the official statement and minutes here: Bank of England Monetary Policy Summary and minutes of the Monetary Policy Committee meeting

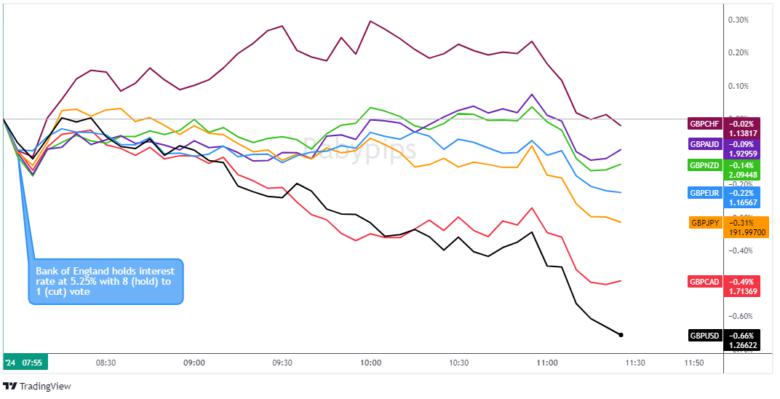

GBP Price Action Following the Policy Hold

Overlay of GBP vs. Major Currencies Chart by TradingView

It was a clear that with eight votes to hold, a majority of the Monetary Policy Committee decided to hold interest policy as expected, including notable hawks Catherine Mann and Jonathan Haskel, who likely switched to the “hold camp” on the recent downswing in CPI data (falling from 4.0% y/y in January to 3.4% y/y in February). Swati Dhingra was the lone member voting for a 25 bps rate cut.

So, while inflation rates are moving in the right direction, 3.4% y/y is still well above target and there are parts of the inflation spectrum that could stay elevated. BOE Governor Andrew Bailey discussed this point in an interview on Thursday, acknowledging that inflation is indeed cooling off but warned that stubborn pockets remain, especially in the services sector.

Governor Bailey and the team seems determined not to get ahead of themselves, and wants to see more evidence of a sustained decline in inflation before easing off the monetary brakes. He did, however, concede that the market’s expectation of three rate cuts this year was “reasonable” – a small glimmer of hope for those eager for lower borrowing costs and likely why the British pound stayed net bearish through the rest of the London session following today’s event, as seen in the chart above.

Hot

No comment on record. Start new comment.