FOLLOWME Community Trading Report the third quarter of 2020

Introduction:

Since the beginning of the year, the global outbreak of COVID-19 has prompted countries and major economies around the world to adopt a series of large-scale economic stimuli to ease policies. Central banks, led by the Federal Reserve, have adjusted their monetary policies to inject liquidity into the market.

Judging from some economic data and market performance in the third quarter, the economic recovery has achieved certain results, and the international financial market has also seen huge fluctuations. In the process of the slow recovery of the global economy, representative non-farm payrolls continued to improve, and overall economic activity rebounded.

At the same time, in the face of the risk of economic recession, central banks of various countries have revised their monetary policies to improve liquidity while rising inflation expectations have also boosted the price of gold. After the crisis of cash liquidity tensions in the initial stage of the epidemic was eased, market confidence was somewhat restored and various risk assets were sought after.

Dollar, as the world's reserve currency, experienced a sharp depreciation under the background of the flood, which indirectly promoted the strong rebound of non-U.S. currencies.

In the third quarter, the forex industry continued to be positively affected by COVID-19. The violent volatility of the market meant more opportunities for traders, benefiting them. FOLLOWME Trading Community’s order volume continued to increase, the efficiency of Brokers’ follow order has generally improved, the proportion of profitable accounts of traders has increased overall, and the advantage of copy trading has further emerged.

The number of profitable accounts of follow traders increased by nearly 9 percentage points compared to the first half of the year, reaching 48.4 %.

FOLLOWME's third-quarter community trading report includes a market overview and trader interviews, in hopes of creating a broader perspective and richer content to show readers the overall overview of community trading under the epidemic.

Market Overview

Main macroeconomic data and policies

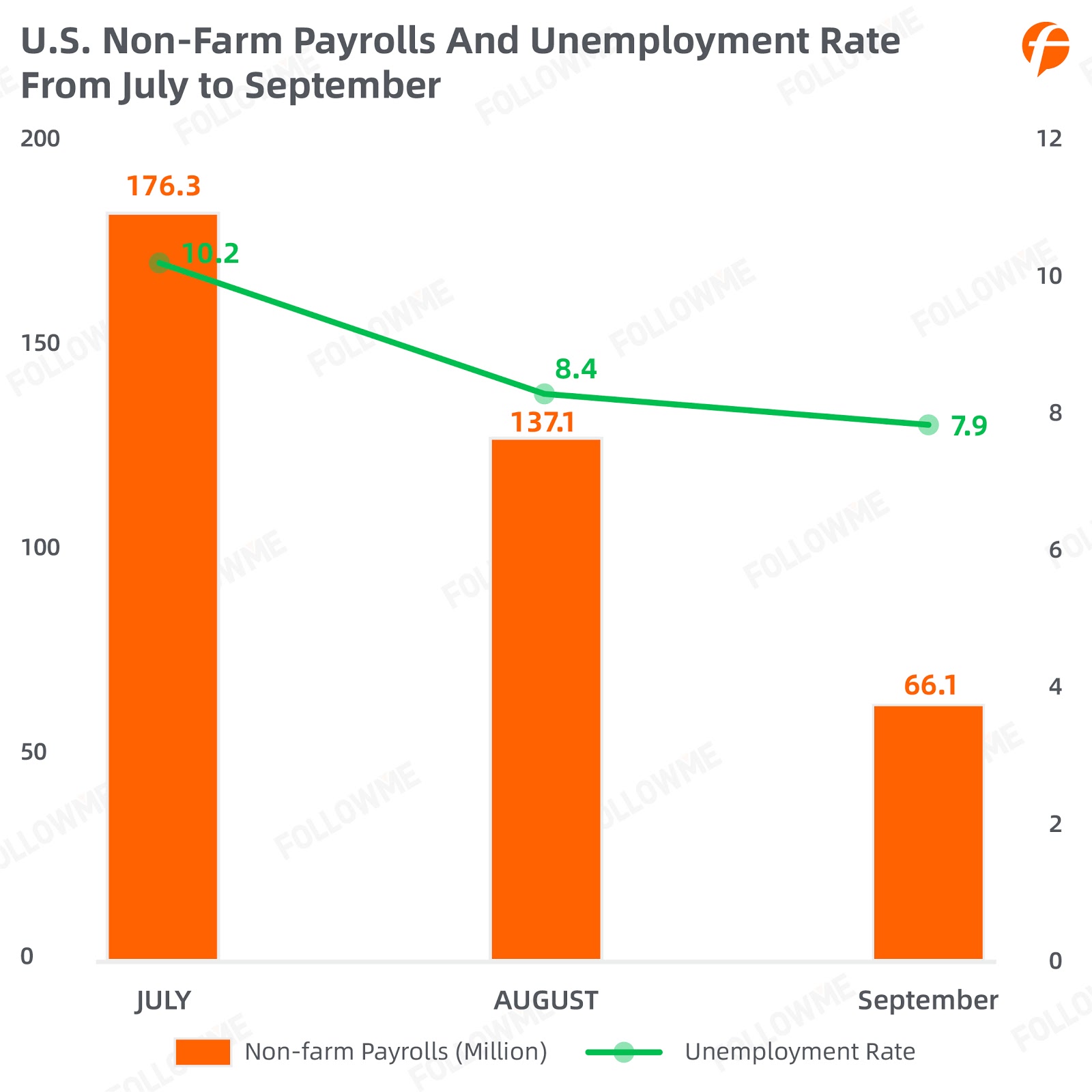

- U.S. non-farm and unemployment rate

With the implementation of economic stimulus measures, the effective control of the epidemic, or people’s gradual adaptation to the epidemic, the U.S. economy has begun to recover, and the work resumption and production has gradually revived. The non-agricultural employment data in the third quarter of 2020 showed a continued positive trend.

Although the number of non-farm new jobs decreased for three consecutive months, the unemployment rate continued to decline, indicating that the U.S. economy was gradually improving in the third quarter.

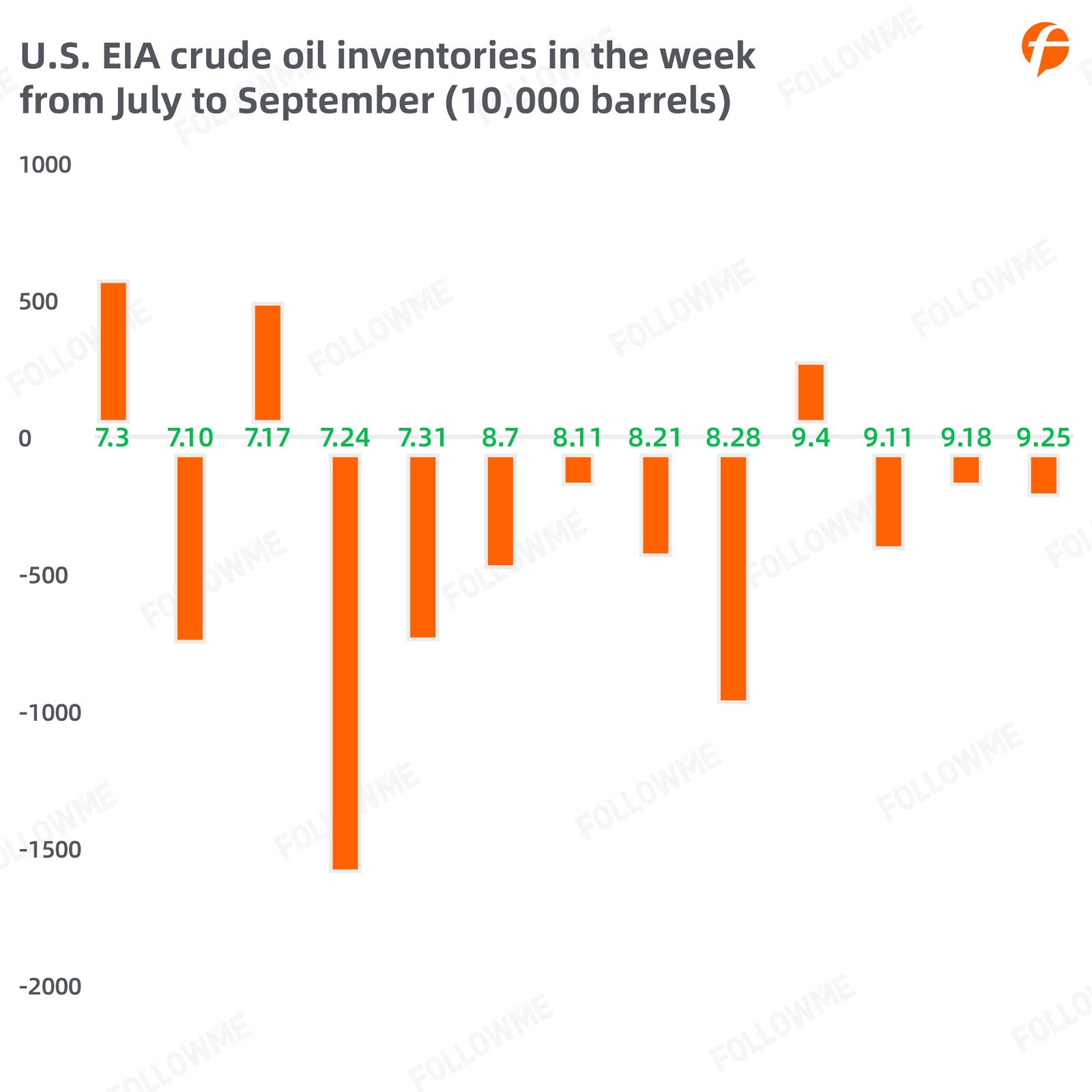

- EIA crude oil inventory

Judging from the environmental impact assessment (EIA) crude oil inventory data released from July to September, the OPEC+ organisation's production cut has achieved certain results, and the supply-side impact has been improved. Crude oil inventories have generally continued to decrease, which has also supported oil prices to a certain extent, but it is crucial that the production reduction agreement can be continued.

The development trend of the epidemic is also an uncertain factor affecting oil demand. If the demand side is not improved, the pressure on crude oil inventories cannot be effectively released, which will still put pressure on oil prices.

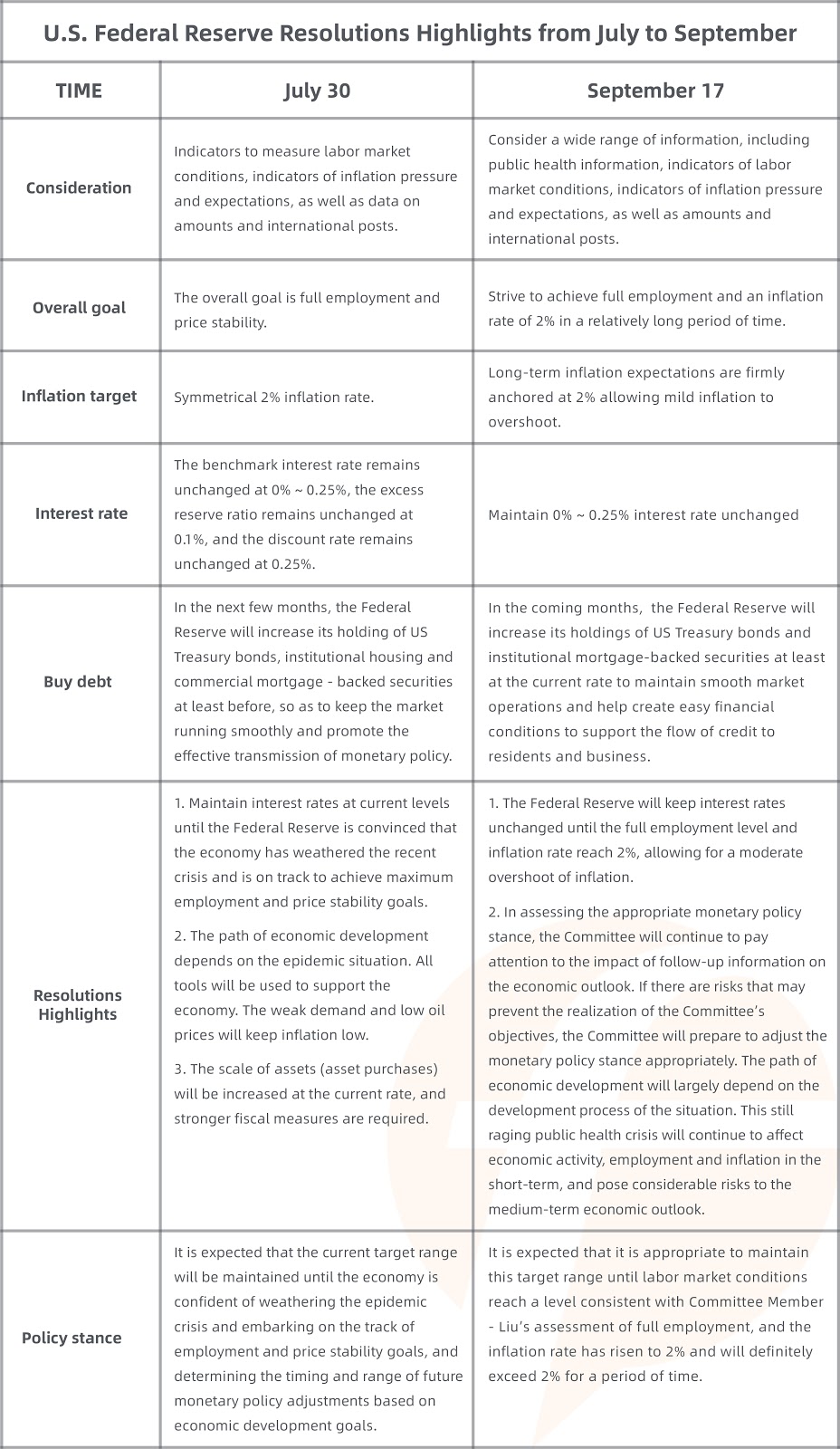

- Federal resolution

In the third quarter, the Federal Reserve held meetings on July 30 and September 17. The two meetings decided to maintain the 0%-0.25% interest rate unchanged, and the 2% inflation rate target unchanged, but allowed to exceed it moderately. Although the Federal Reserve has begun to purchase a large number of bonds, the marginal utility of continued expansion of the balance sheet is decreasing. It does not help the real economy.

The interest rate trend in the next two and a half to three years is very clear. It is likely that interest rates will remain at their original levels before the U.S. passes the epidemic.

The long-term low interest rate environment is likely to cause financial market bubbles. Government and corporate debt problems may become more serious, and there is not much room for monetary policy implementation. Therefore, the Federal Reserve continues to pressure the government to launch more fiscal stimulus plans.

Changes in Major Market Conditions

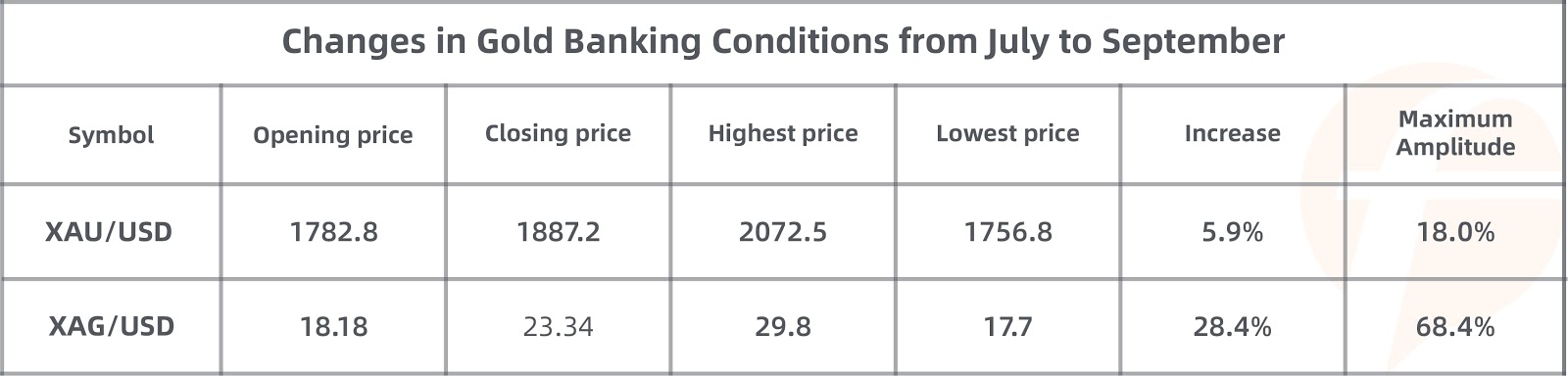

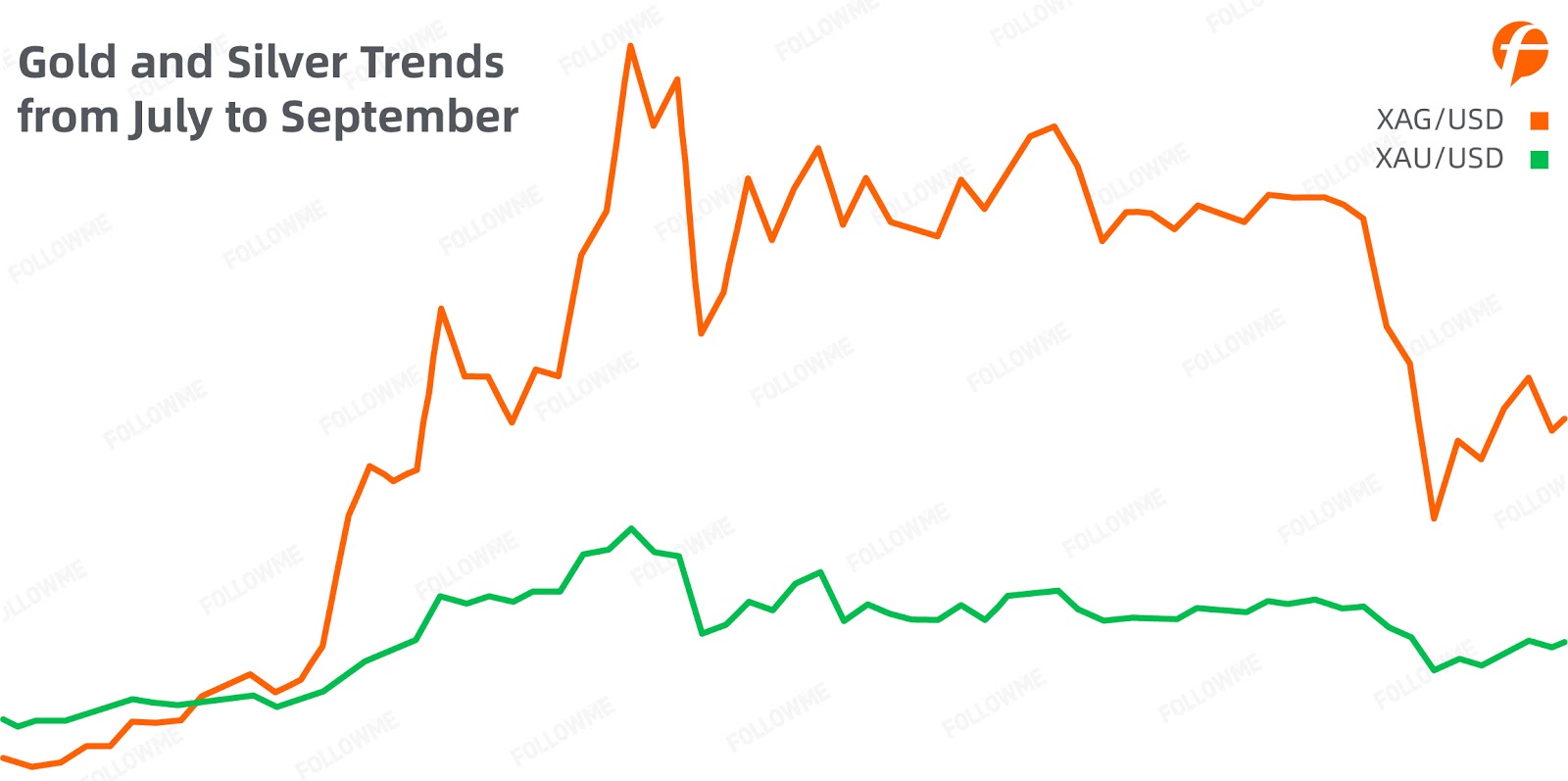

- Gold and silver (XAU/USD, XAG/USD)

In the third quarter, gold and silver experienced a fantastic and epic roller coaster market. After the mad bull market was staged from July to August, gold and silver entered the wild and giant shock mode. The amplitude of gold reached 18%, and the maximum amplitude of silver was as high as 68.4%. The market is also breathtaking in the highly leveraged forex market.

Gold's intraday volatility used to fluctuate hundreds of points at every turn, reaching as high as 2070, and now it has fallen to around 1900. The increase in the price of silver far exceeds that of gold, which not only demonstrates the same precious metal hedging properties as gold but also demonstrates its industrial properties that have been strengthened with the recovery of the manufacturing industry. The gold-to-silver ratio index once dropped from 100 to around 80.

There are two main reasons for the volatility and decline since mid-August. One is that gold and silver have gained too much in the previous period, and there is pressure for profit taking. Second, the continued good U.S. employment data, vaccine progress, and expectations of a new round of economic stimulus bills have increased market preferences, and global stock markets have been bullish, prompting the withdrawal of some safe-haven funds.

However, in the context of continued monetary easing, the uncertainty of the U.S. general election and the impact of the rebound of the epidemic may become a catalyst for a new round of precious metals market.

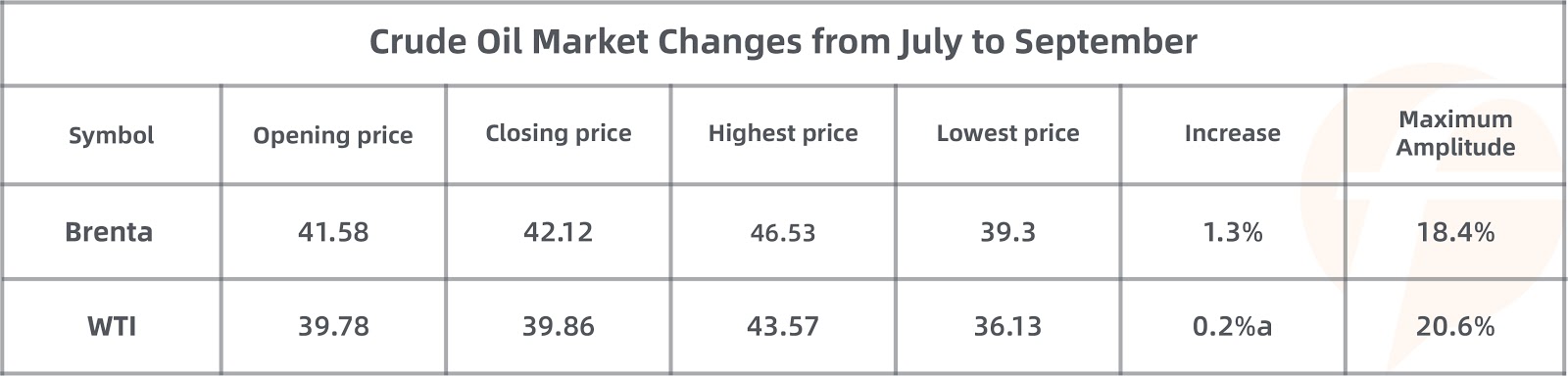

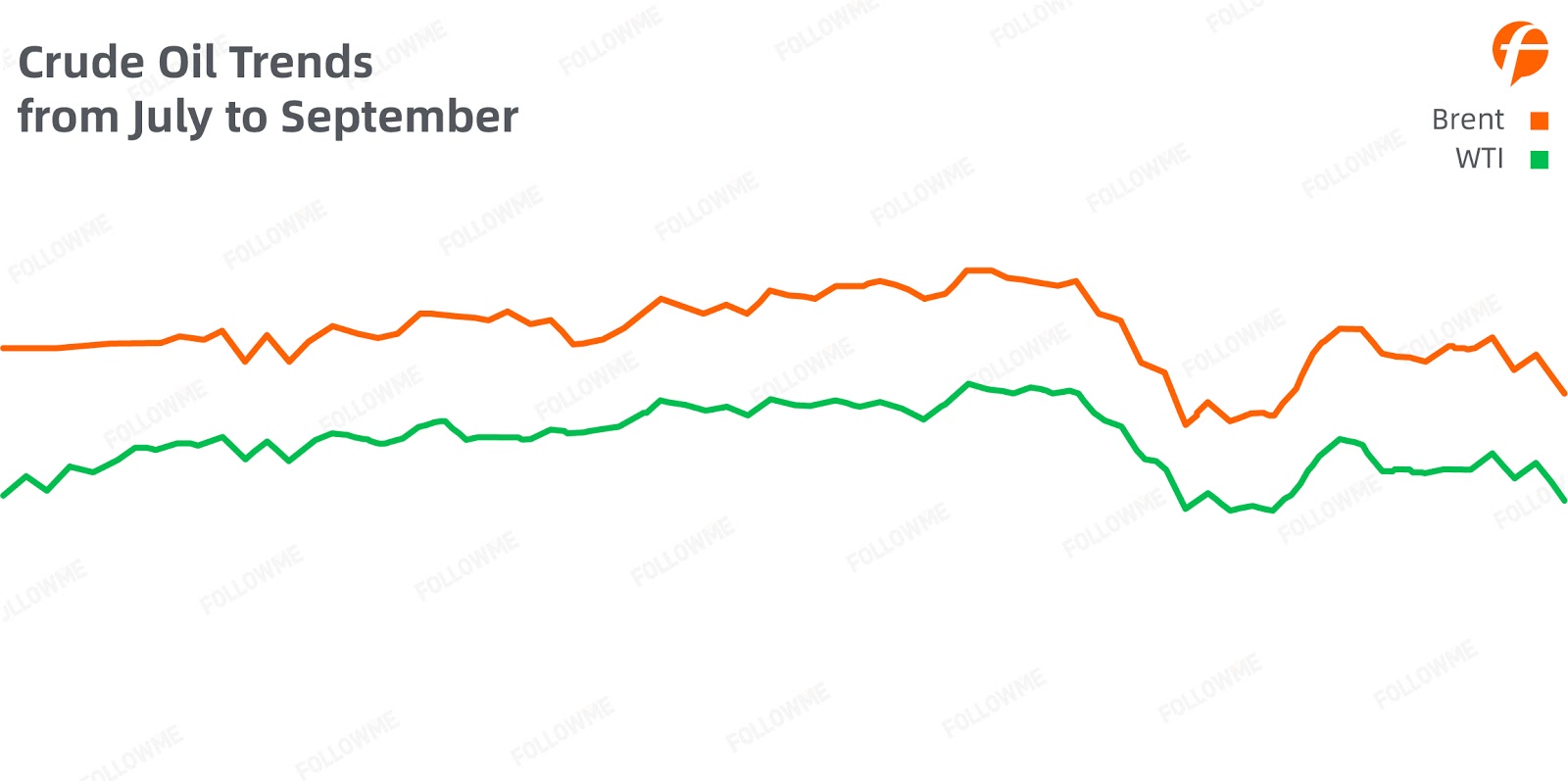

- Crude

Judging from the changes in crude oil prices from July to September, the trends of U.S. oil and oil distribution have basically kept pace. The overall market remained in a narrow range throughout the third quarter. Most of the time, the market was relatively flat, and trading opportunities were mainly concentrated in the first half of September, with the largest amplitude. Close to 20%, the trading space is large enough.

At the beginning of September, there was an obvious and rapid decline in the market, mainly due to the rebound of COVID-19 cases in many countries in Europe and the U.S. and India, which hit oil demand. In the future, oil prices will be determined mainly on the demand side. The rebound of the epidemic will have a far-reaching impact on demand.

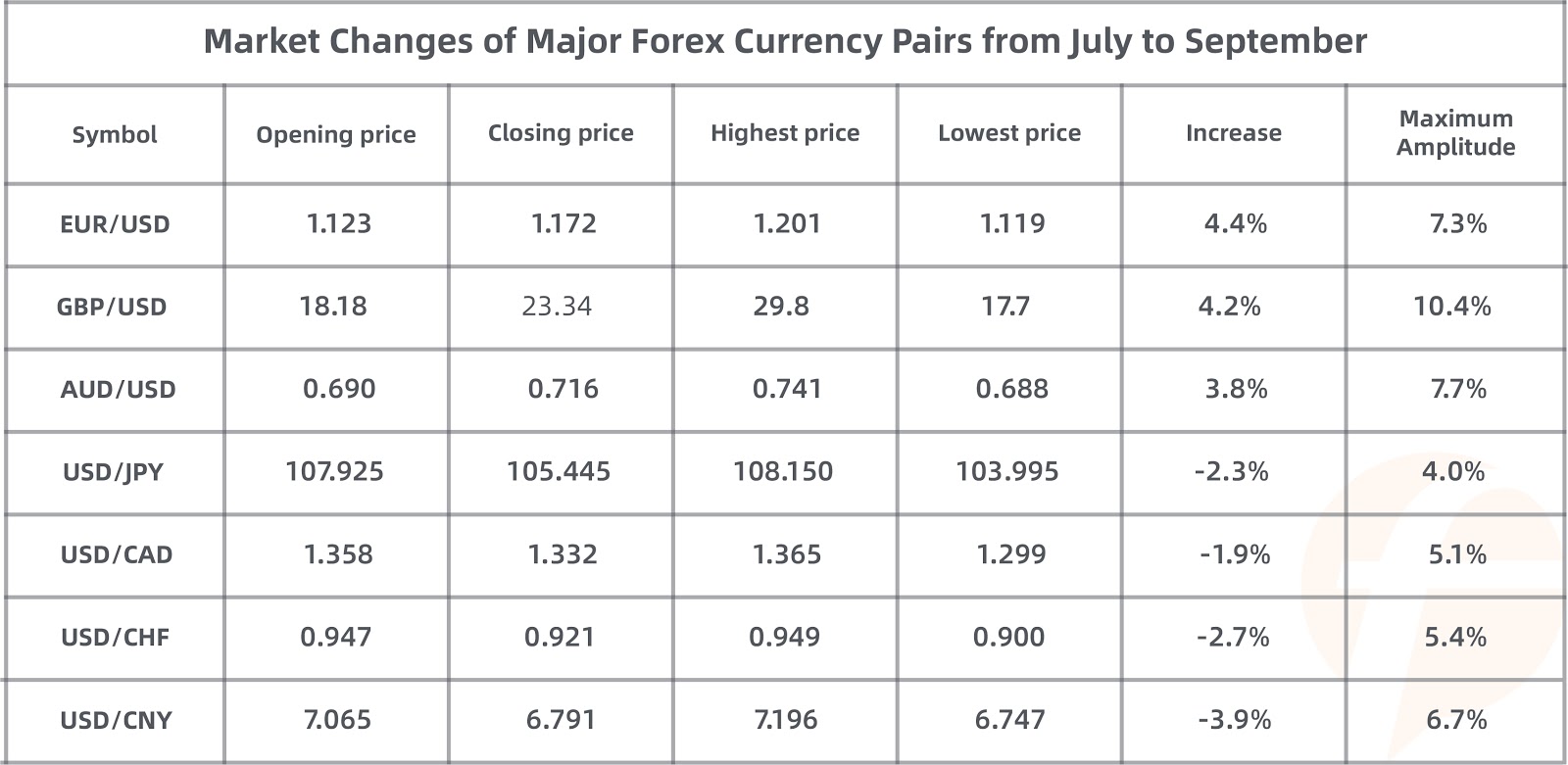

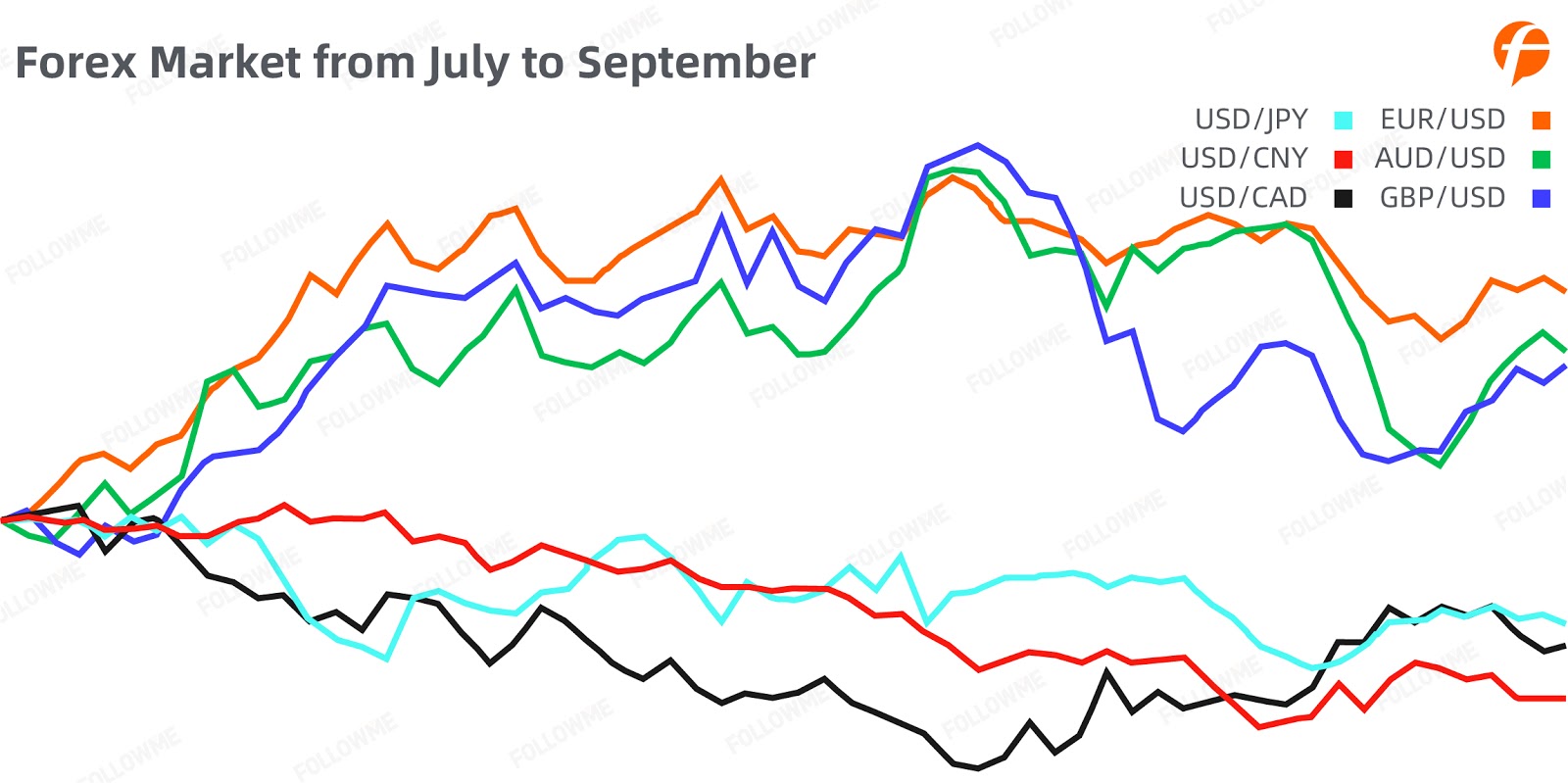

- Market changes of major forex currency pairs

In the third quarter, the U.S. dollar index continued to weaken, and non-U.S. currencies rose collectively. The euro, pound sterling, and renminbi were among the top three gainers. Both the euro and the renminbi benefited from the speed of effective control of the epidemic, and the economic recovery momentum was good.

Brexit negotiations have reached a deadlock and have become a spoiler for the trend of the pound and the euro. The pound has also given full play to its volatility and has lived up to expectations as the non-U.S. currency with the largest amplitude. The Swiss franc and the Japanese yen tend to be relatively stable due to their own risk-averse properties.

In terms of commodity currencies, the Canadian dollar has recovered better than the United States due to crude oil prices, and the exchange rate has also been relatively strong, with the smallest increase of 1.9% in the third quarter.

The RBA’s continued firm dovish stance and the economic and trade difficulties between China and Australia have put pressure on the Australian dollar, and the growth rate has been suppressed to a certain extent.

Broker Overview

- Trading scale

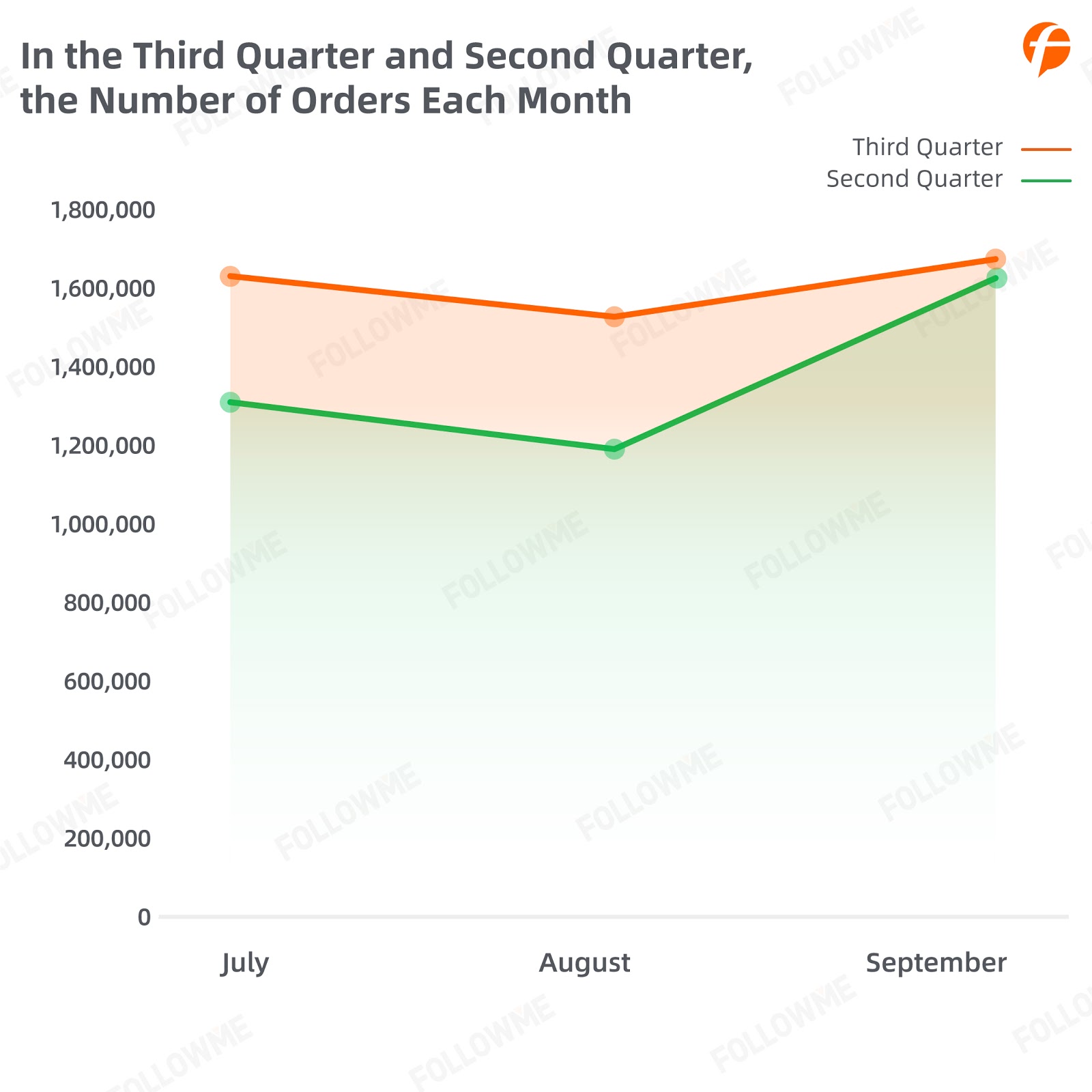

In the third quarter of 2020, the total number of trading orders in the FOLLOWME community was approximately 4.83 million, an increase of 18.6% from the second quarter. The overall change in the order volume of July, August, and September was relatively small. Among them, the number of orders in September is the highest at 1.626 million.

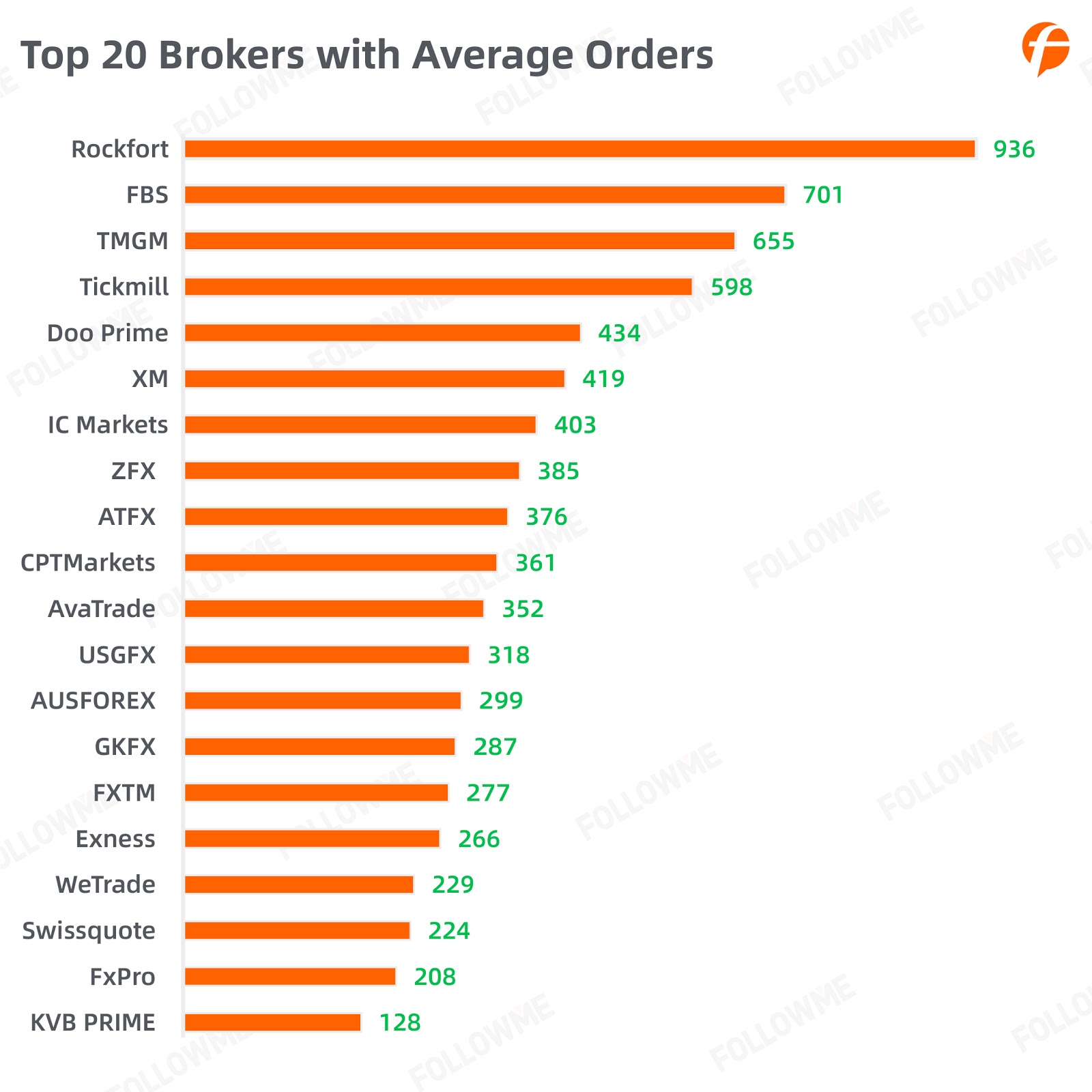

- Average number of orders in trading account

In the third quarter of 2020, a total of 233 Brokers were active in the FOLLOWME community, with approximately 15,000 active accounts. The trading accounts generated 4.83 million orders in total, and the average number of trading accounts was 322 with a decrease of 24.1% from the first half of the year. Among them, the top 20 Brokers' average order number of accounts were above 110 with the highest at 936, which was an increase from 760 in the first half of the year.

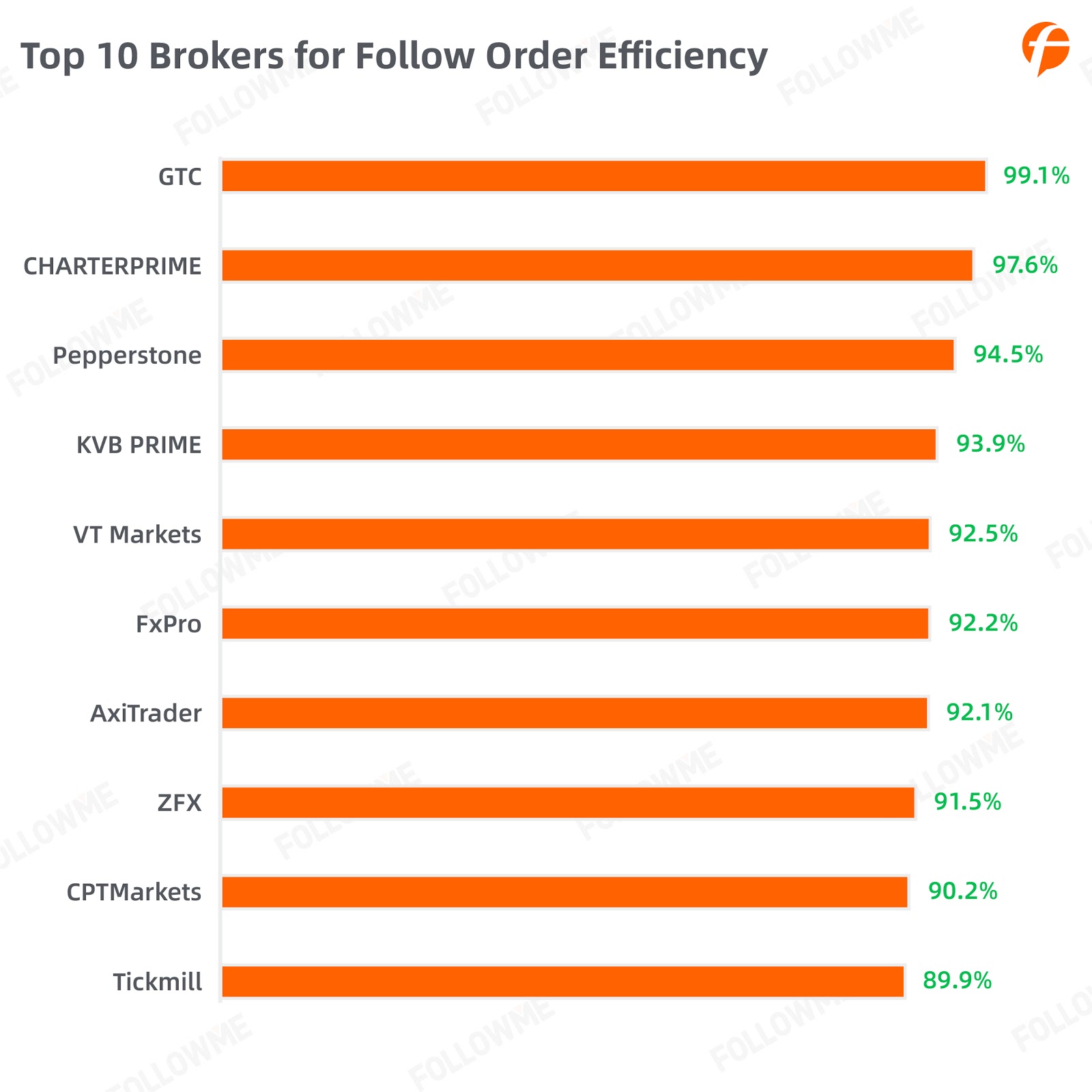

- Broker copy trade order efficiency

FOLLOWME community’s total number of copy trade orders in the third quarter was about 800,000, of which 676,000 copy trade orders were opened and closed within ONE second, accounting for 84.5%, compared with 76.1% in the first half of the year. This translates into an improvement in the processing efficiency among these brokers.

Comparing the data in the first half of the year, the top 10 Brokers in the third quarter achieved better results with their better efficiency. It is also worth mentioning that in the same period, GTC, the most efficient Broker, accounted for 99.1% of orders within one second.

- Proportion of trading account profit and loss

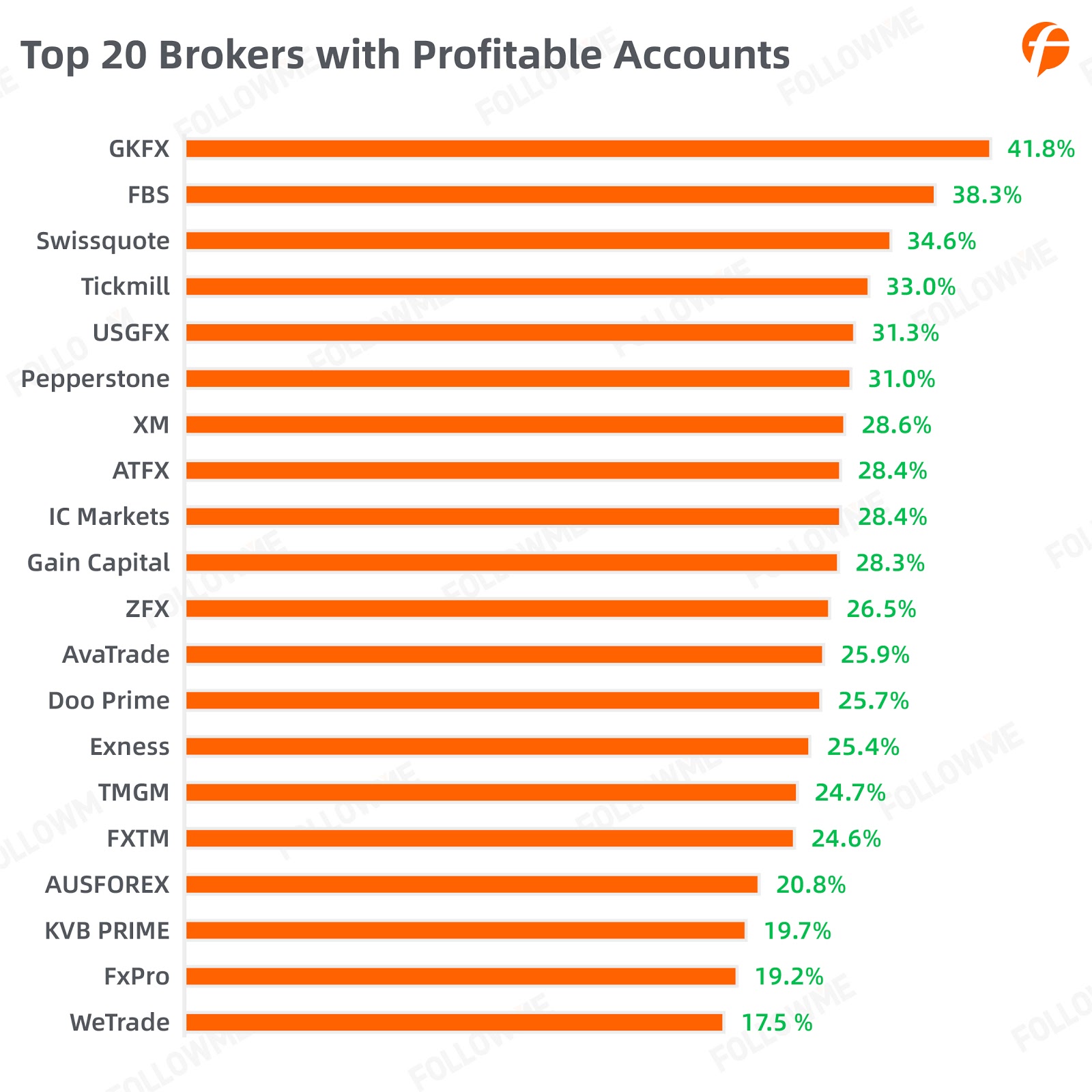

The average percentage of profitable trading accounts of active Brokers in the FOLLOWME community was 25.5%, an increase of three percentage points from the first half of the year. Among the top 20 Brokers with profitable accounts in the third quarter, all of them were compared with their respective data in the first half of the year except for except FXTM and CPTMarkets.

On the improvement in the profitable accounts ratio, the top five has shown significant jump and the best of them all, GKFX has increased by 14% compared to its data in the first half of the year.

- Brokers new account registration

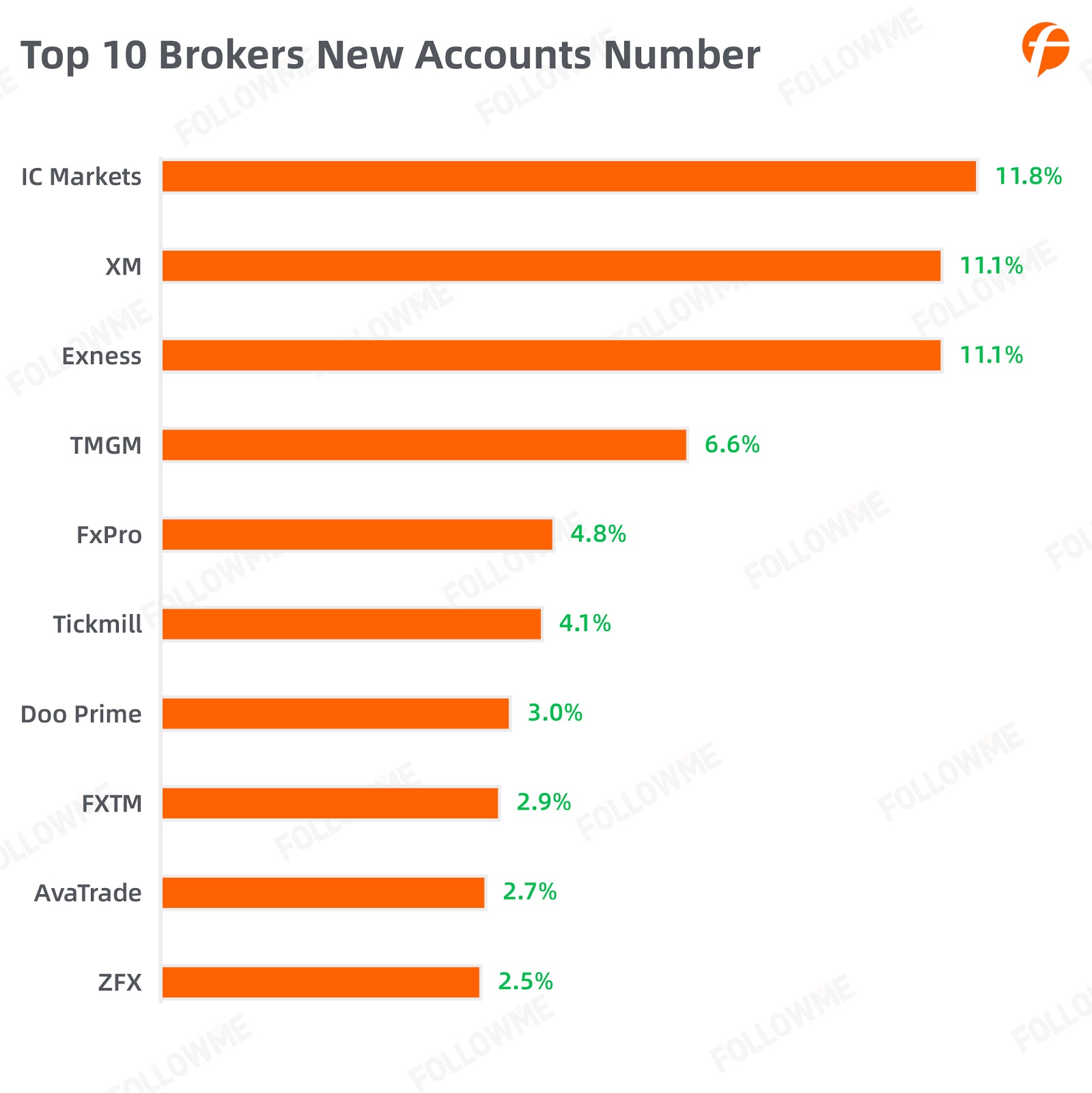

In the the third quarter, trader IC Markets saw the largest number of new accounts registration, accounting for 11.8%, followed by XM and Exness, which together accounted for 34%.

Although IC Markets replaced the regulator in the third quarter, IC Markets has became the most popular Broker among the new users on FOLLOWME community due to its low spreads. It shows that when a new user chooses a Broker, the platform spread is a very important factor.

Users overview

- Gender, age, and region distribution

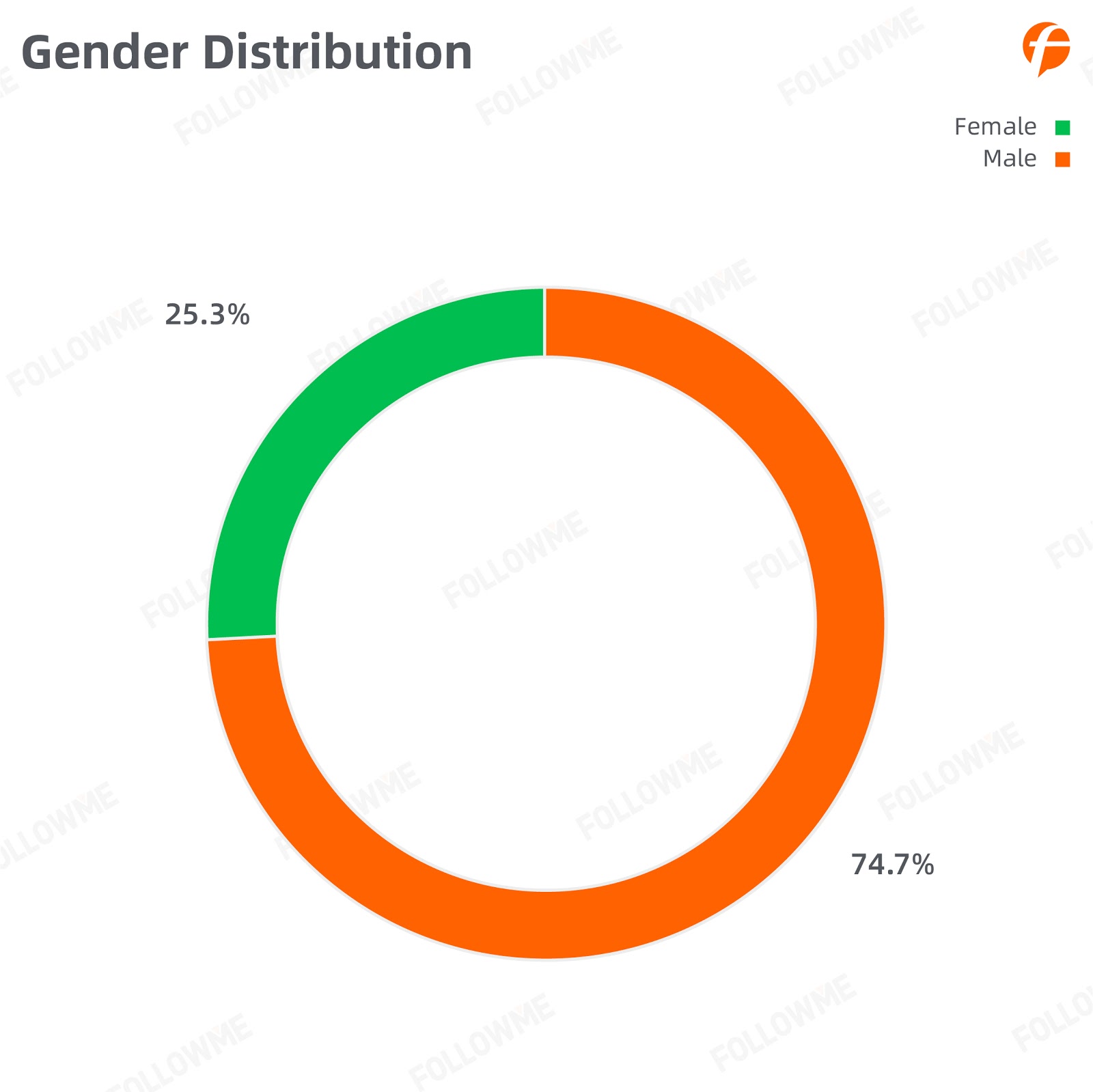

In the third quarter of 2020, the ratio of male and female users in the FOLLOWME community was 74.7% and 25.3%, respectively. Compared with the data in the first half of the year, the percentage of females fell by about 5 percentage points, and the percentage of males rose relatively.

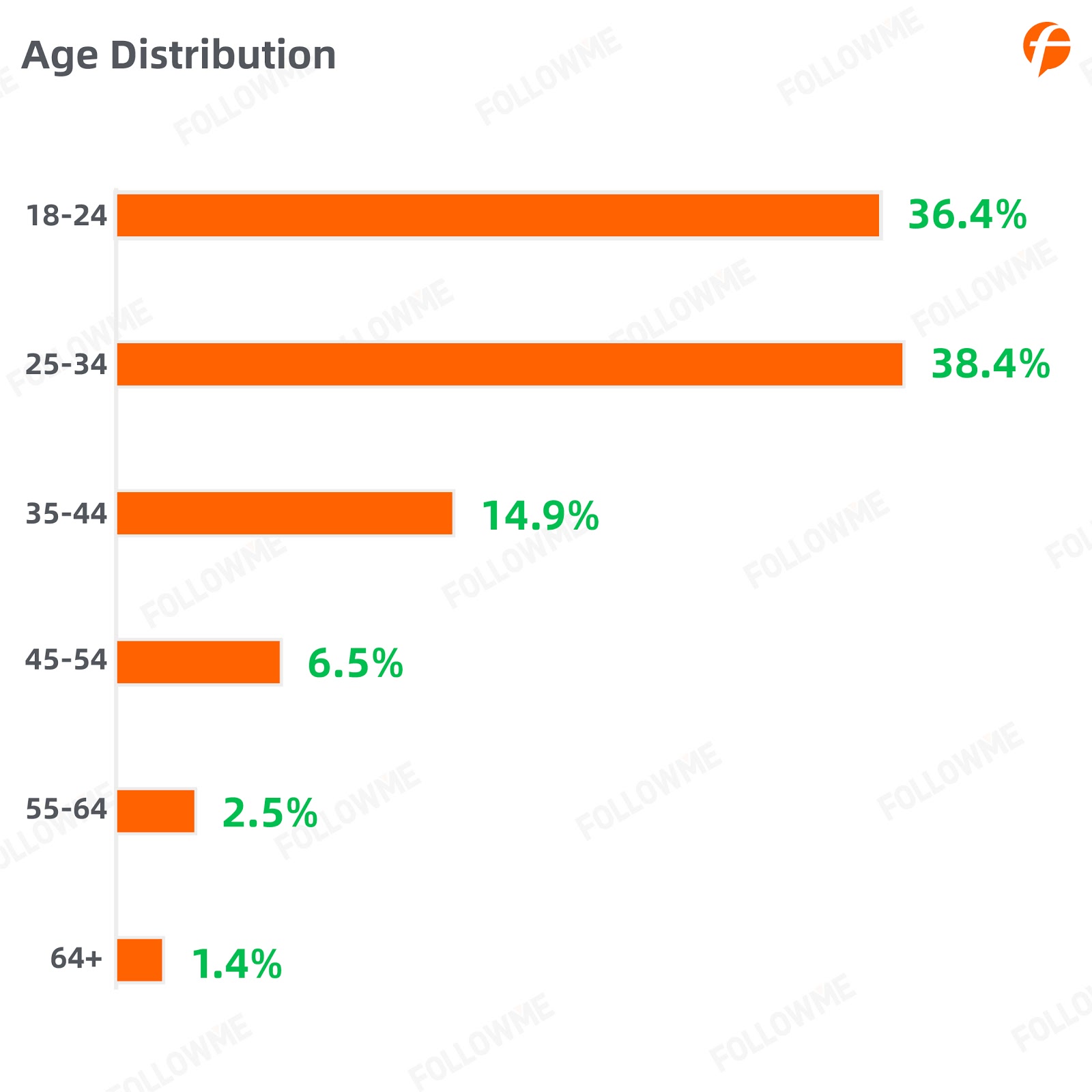

From the perspective of age distribution, users aged 18-34 constitute the main body of the community, accounting for about 3/4 of the total community users, an increase of 4.8 percentage points from the first half of the year. Among them, the proportion of users aged 18-24 has increased by 10.9%, while the number of users aged 25-34 has decreased by 6.1%. The trend of younger users in the community is further highlighted.

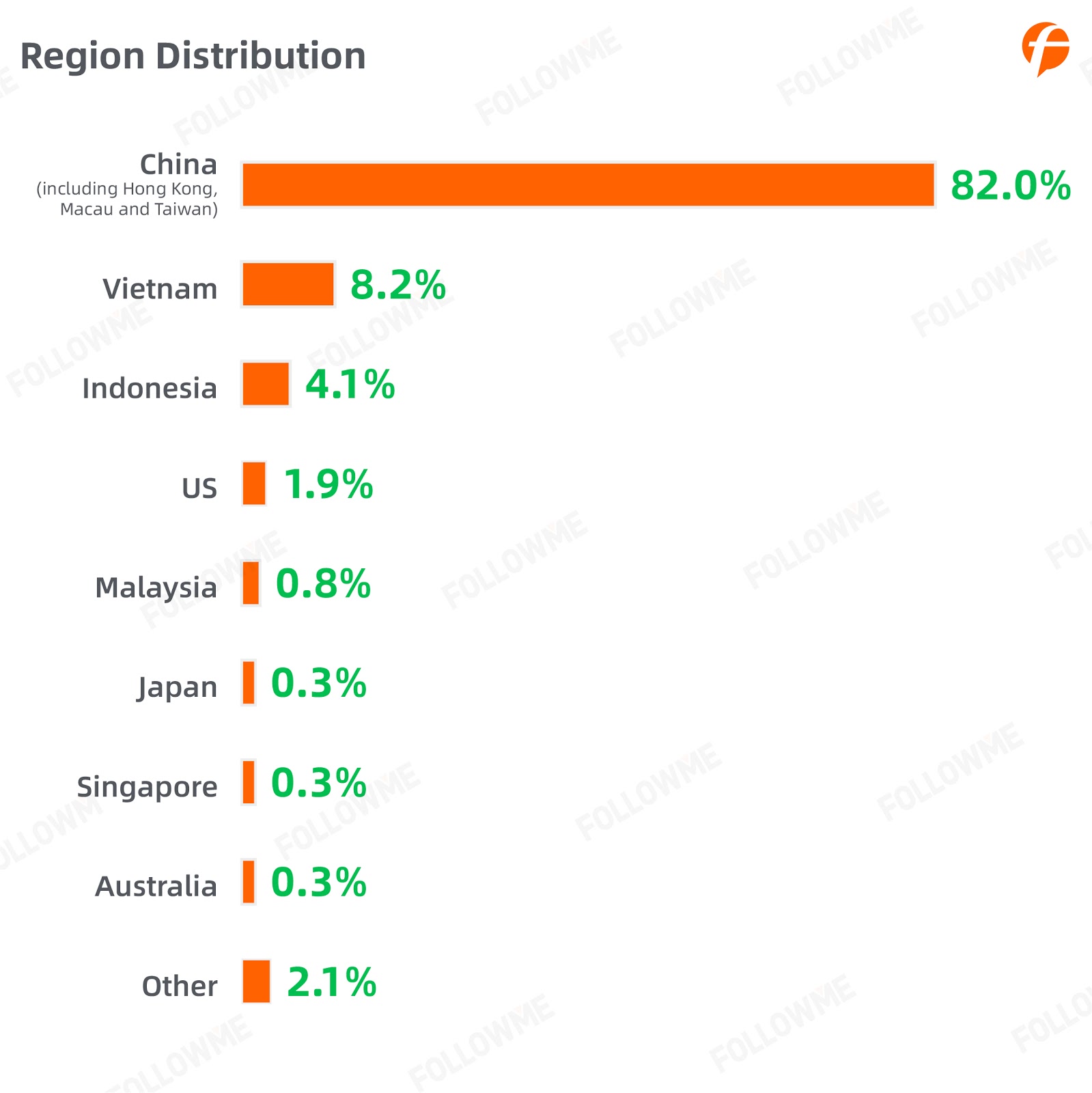

In terms of region distribution, China is still the country with the largest number of users in the FOLLOWME community, accounting for 82.0%, an increase of nearly 10 percentage points from the first half of the year. Followed by Vietnam and Indonesia, the proportion of users in these regions is basically the same as in the first half of the year.

- Number of Bound Broker/s

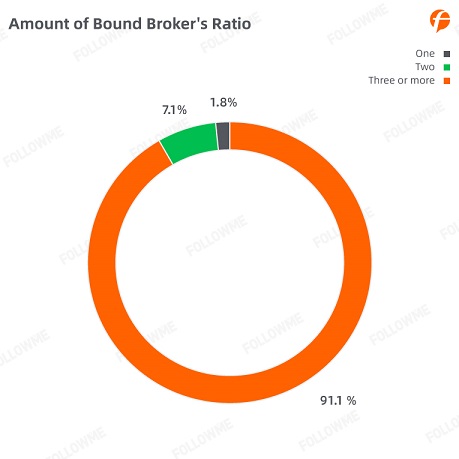

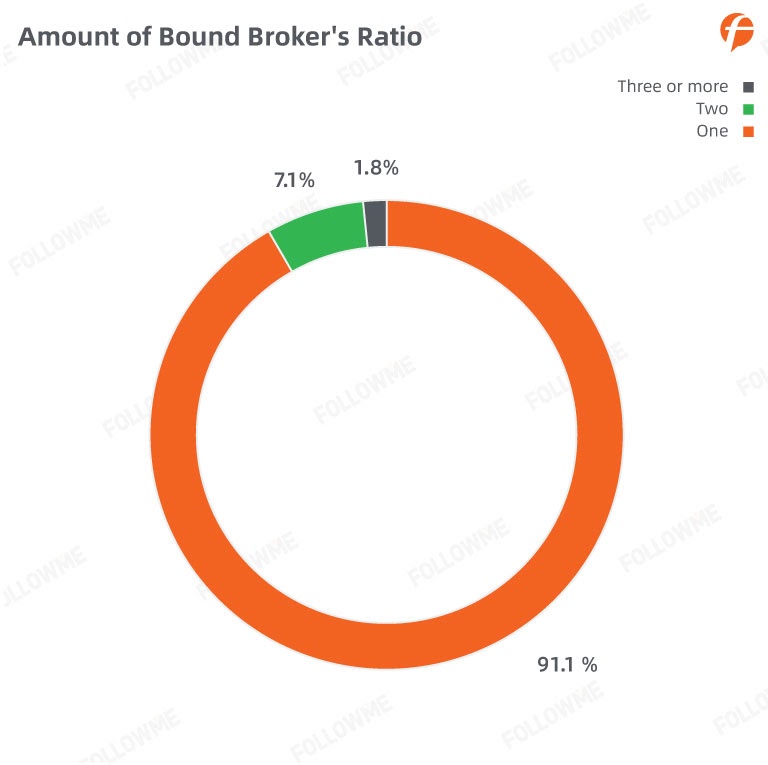

91.1% of users in FOLLOWME Trading Community only have an account with one Broker, 7.1% have accounts with two Brokers at the same time, and only a very small number of users have accounts with three or more Brokers at the same time. It can be seen from the data that the vast majority of community users have a high degree of loyalty to Brokers. Once a Broker is bound to the users’ accounts, they will rarely consider experiencing the services and trading environment of other Brokers, which also includes cost factor.

- Trading days

During the three months of the third quarter this year, 76.3% of traders had trading days of 1-30 days, 16.9% were 31-60 days, and only 7.8% of users had trading days of more than 60 days on FOLLOWME.

- Position symbols and trading periods

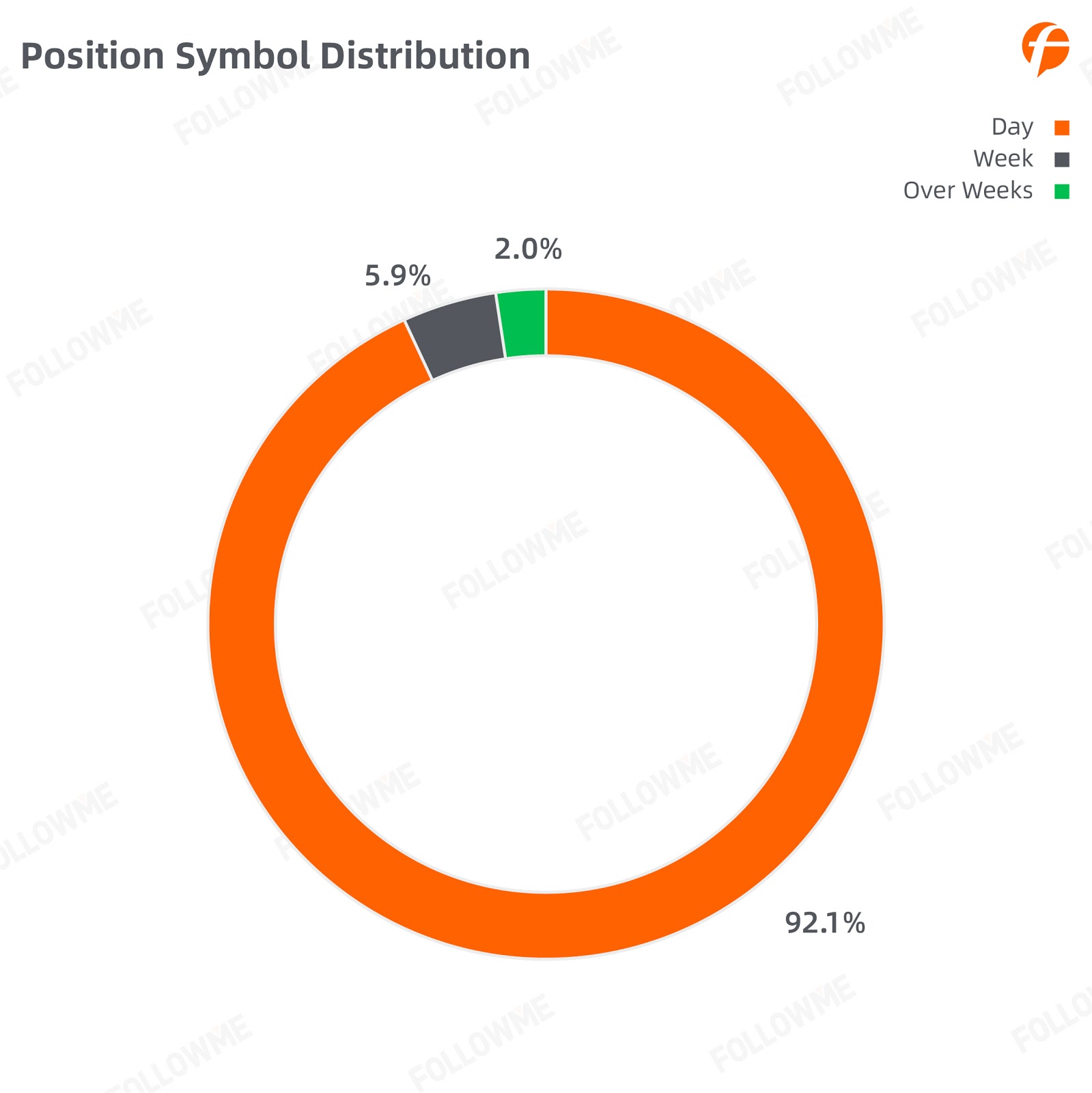

In the third quarter of 2020, intraday holding is still the most common type of holdings in FOLLOWME Trading Community, accounting for 92.1%, an increase of 6.4% from the first half of the year, while transactions within and over a week have been reduced.

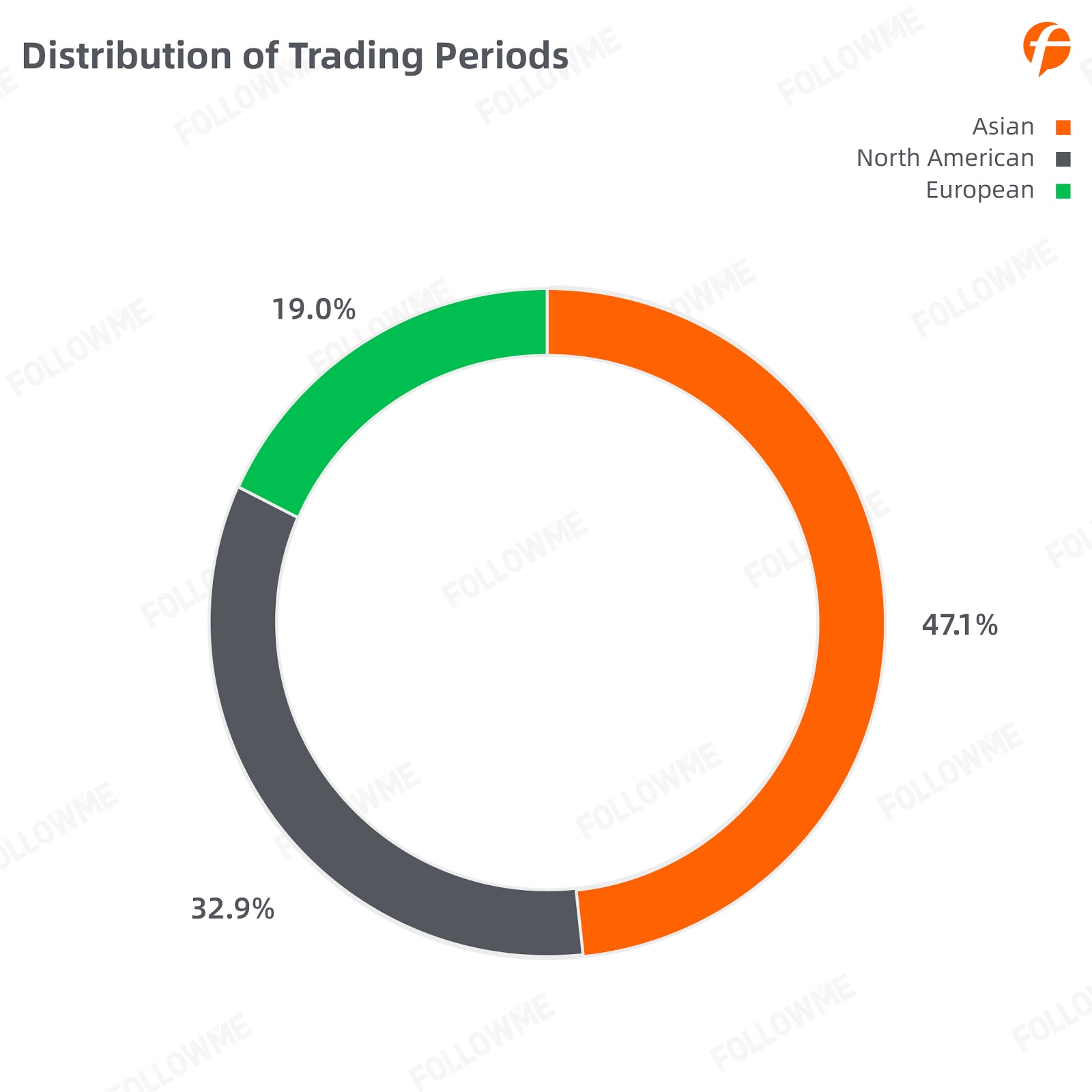

In the third quarter, community users mostly chose to trade during the Asian timezone session, followed by the North American timezone session, and lastly, the European timezone session. Comparing the data in the first half of the year, the ratio of the users in each time period did not change significantly.

- Popular trading symbols

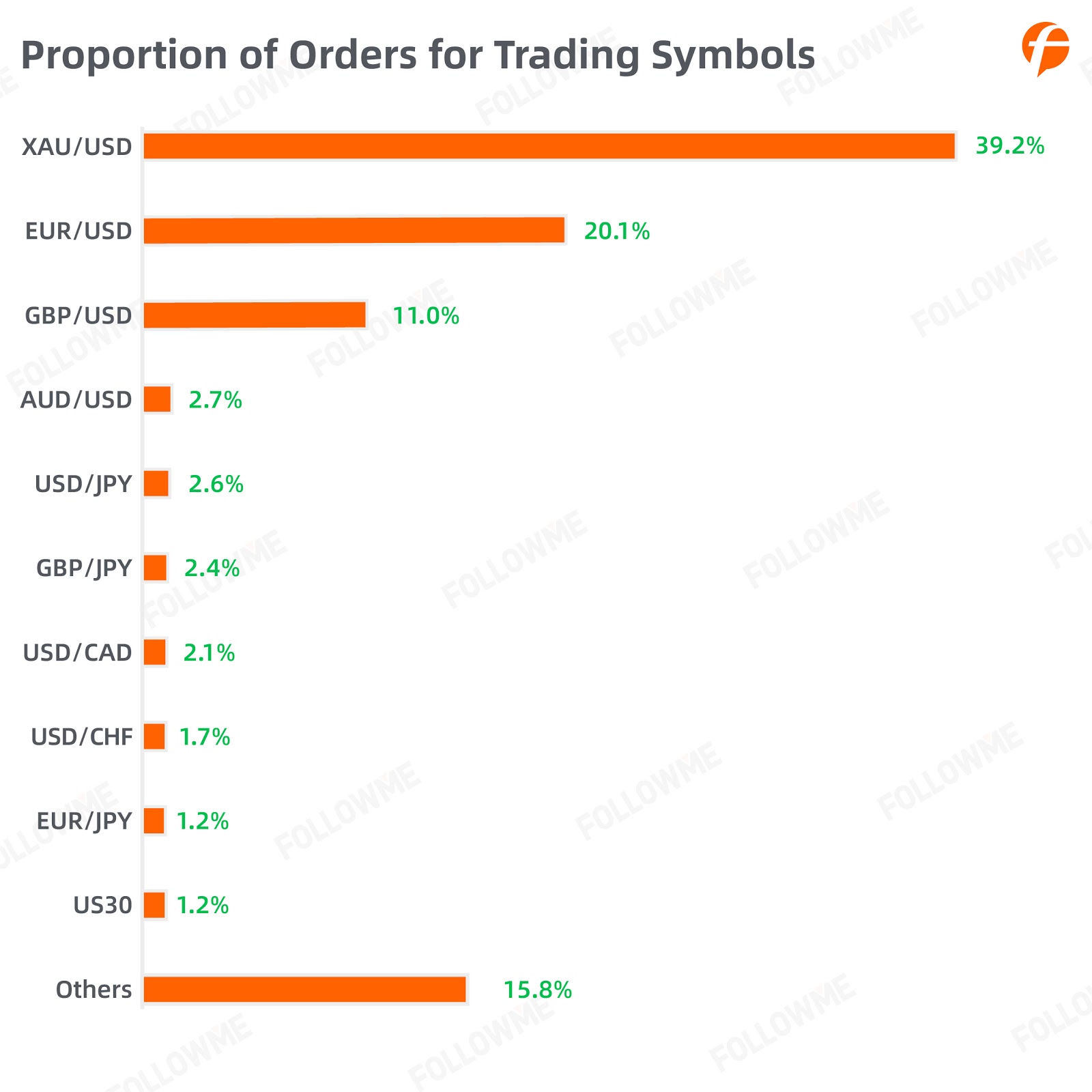

The data shows that the most popular trading product in the community in the third quarter was XAU/USD, followed by EUR/USD. Compared with the first half of the year, the other popular trading products did not change substantially and almost retained the same order.

Overview of Traders and Followers

- Traders and order composition

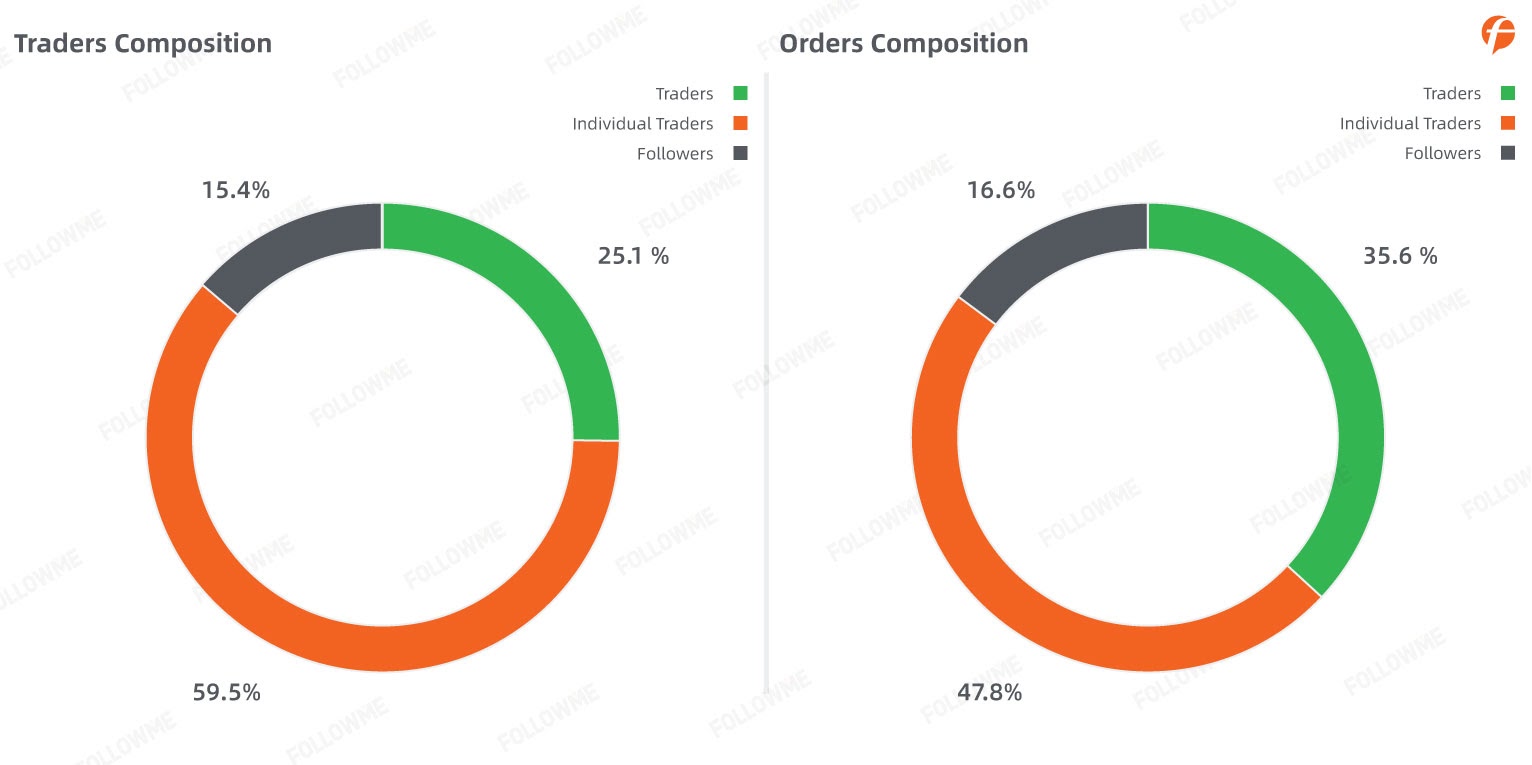

In the third quarter of 2020, there were nearly 15,000 traders in the FOLLOWME trading community. Among them, the number of independent traders was the largest, accounting for 59.5%, followed by traders (signal providers), accounting for 25.1%, and the least - copy traders, accounting for only 15.4%.

At the same time, the number of orders generated by the community totaled 4.83 million, of which 1.72 million were completed by traders, and the number of orders completed by individual traders and copy traders collectively was 311,000. The number of individual trading orders was 2.31 million, accounting for 47.8%, followed by the number of orders generated by traders totaled 1.72 million, accounting for 35.6%, and the number of follow-up orders was the least at 800,000, accounting for 16.6%.

Traders accounted for 25.1% of accounts and generated 35.6% of orders, making them the most active group in the community. While individual traders accounted for 59.5% of the number of users, yet it only generated 47.8% of the total orders.

- Leverage

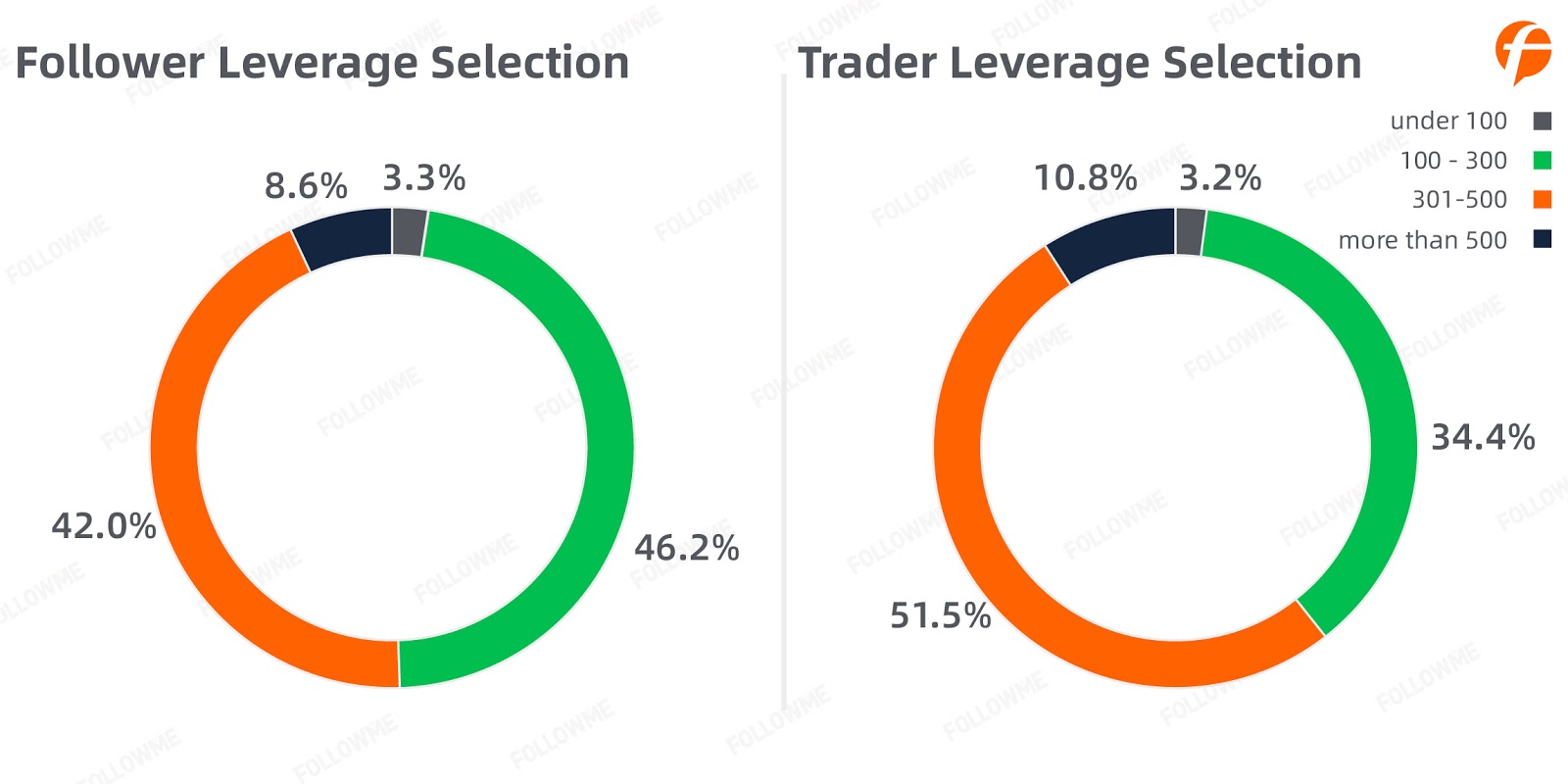

The data shows that leverage of 100-300 times and 301-500 times are the most popular among the copy traders. The number of choices accounted for 46.2% and 42%, respectively. The number of choices with leverage above 300 times accounted for 50.6%.

Among traders, the proportion of people who chose leverage over 300 times is 62.3%. Generally speaking, compared with copy traders/followers, the trader group chooses a higher leverage ratio, but this also means that they have to bear greater risks and require stronger risk control capabilities.

- Deposit scale

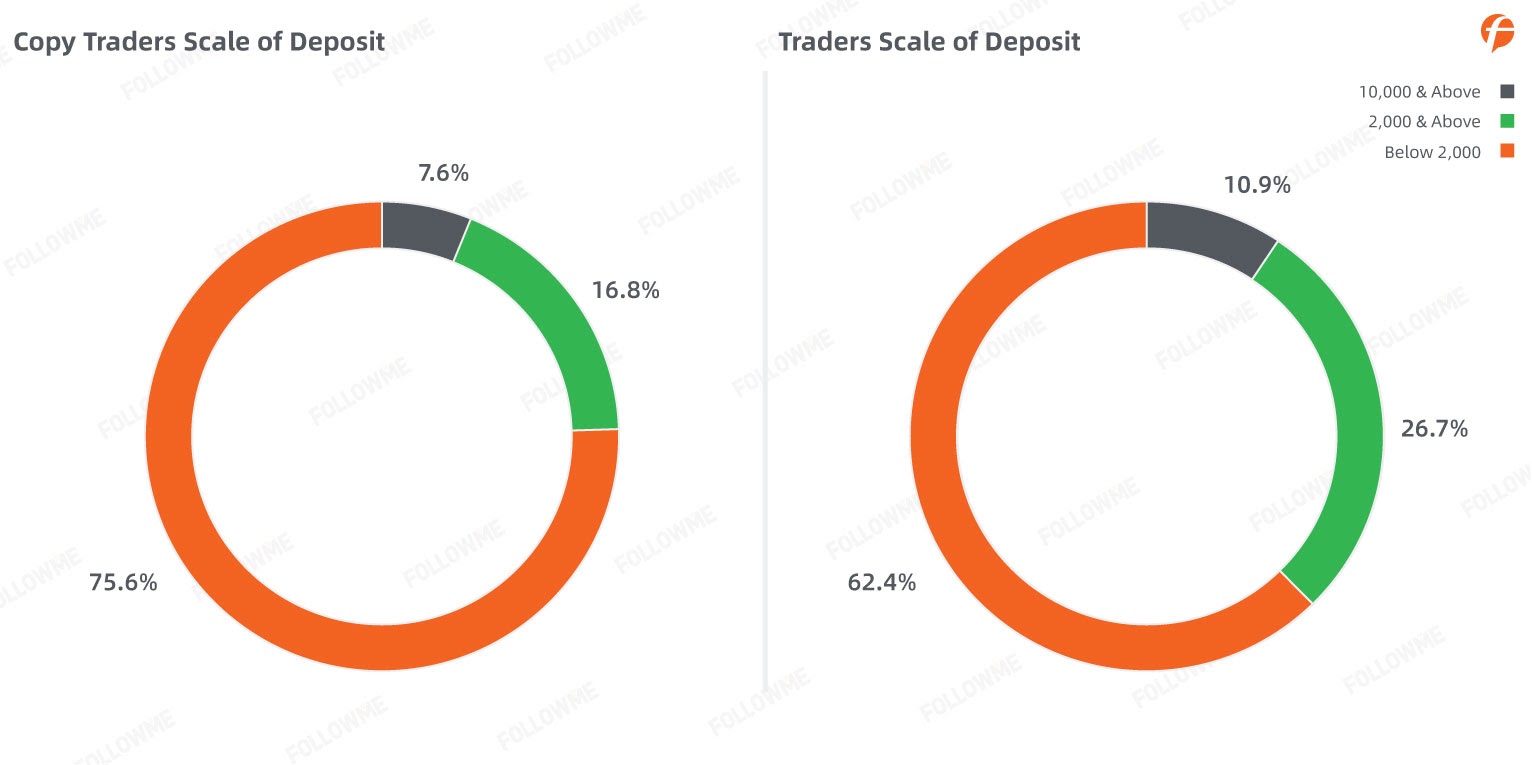

In the third quarter of 2020, more than 3/4 of the copy traders/followers on FOLLOWME community had a deposit of less than $2,000, and only 7.6% of the copy traders/followers had a deposit of more than $10,000.

The deposit scale was also similar among the traders on FOLLOWME. The number of people with a deposit of less than $2,000 accounted for the largest proportion of about 62.4%, and the number of people with a deposit of more than $10,000 accounted for the least, at 10.9%.

However, in the range of $2,000 to $10,000, there is a clear difference in the proportion between copy traders/followers and traders. In this category, the proportion of traders is nearly 10% higher than the proportion of copy traders/followers.

- Proportion of profit and loss (PnL)

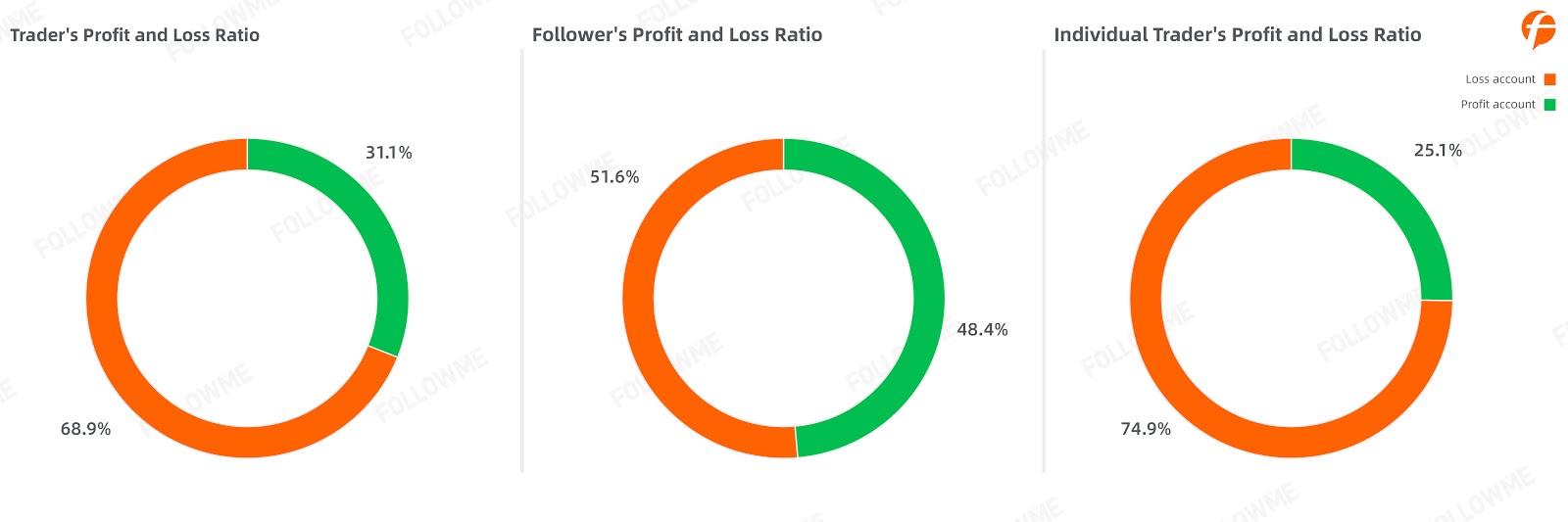

Among traders, profitable accounts accounted for 31.1% while the loss-making accounts accounted for 68.9%. Compared with the first half of the year, the ratio of profitable accounts increased by nearly 10%. Among copy traders/followers, profit earned from their subscribed traders (signal providers) accounted for as high as 48.4%, an increase of nearly 9 percentage points compared with the first half of the year, and their performance was outstanding.

On the other hand, independent traders, profit accounts accounted for only 25.1%, which was significantly lower than traders. Through the comparison of the data, it is solid to assume that for the copy traders/followers in our community, choosing to follow a signal provider’s transaction is more profitable than being an independent trader.

Analysis of trading behavior in the third quarter

In our first half of 2020 report, there were two main reasons of the loss-making by our traders:

1. They are keen to do short-term, but they overlook the cost;;

2. They did not have a backup risk control strategy and were forced to trade long-term to recuperate.

Now that a quarter has passed, do we see a swift in this?

Take a look at this to find out:

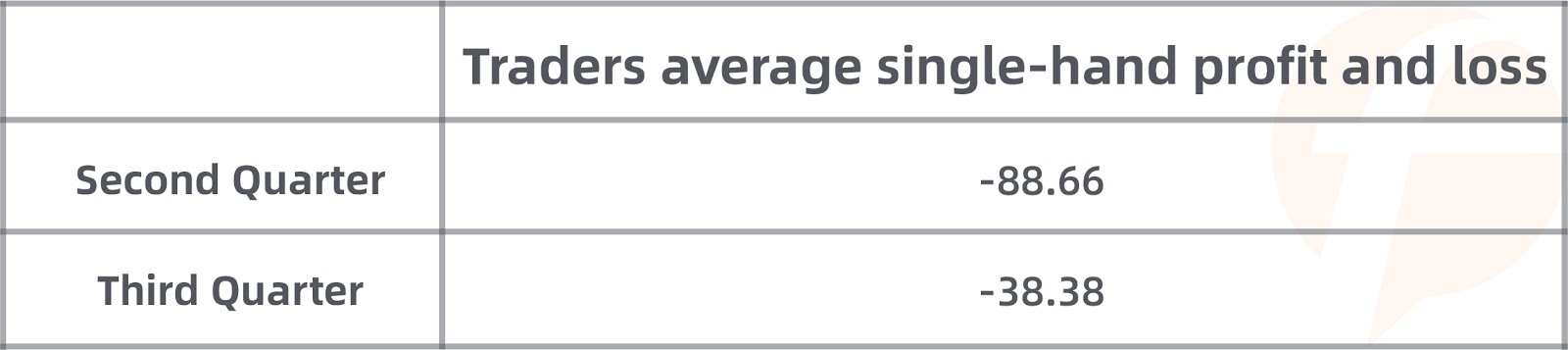

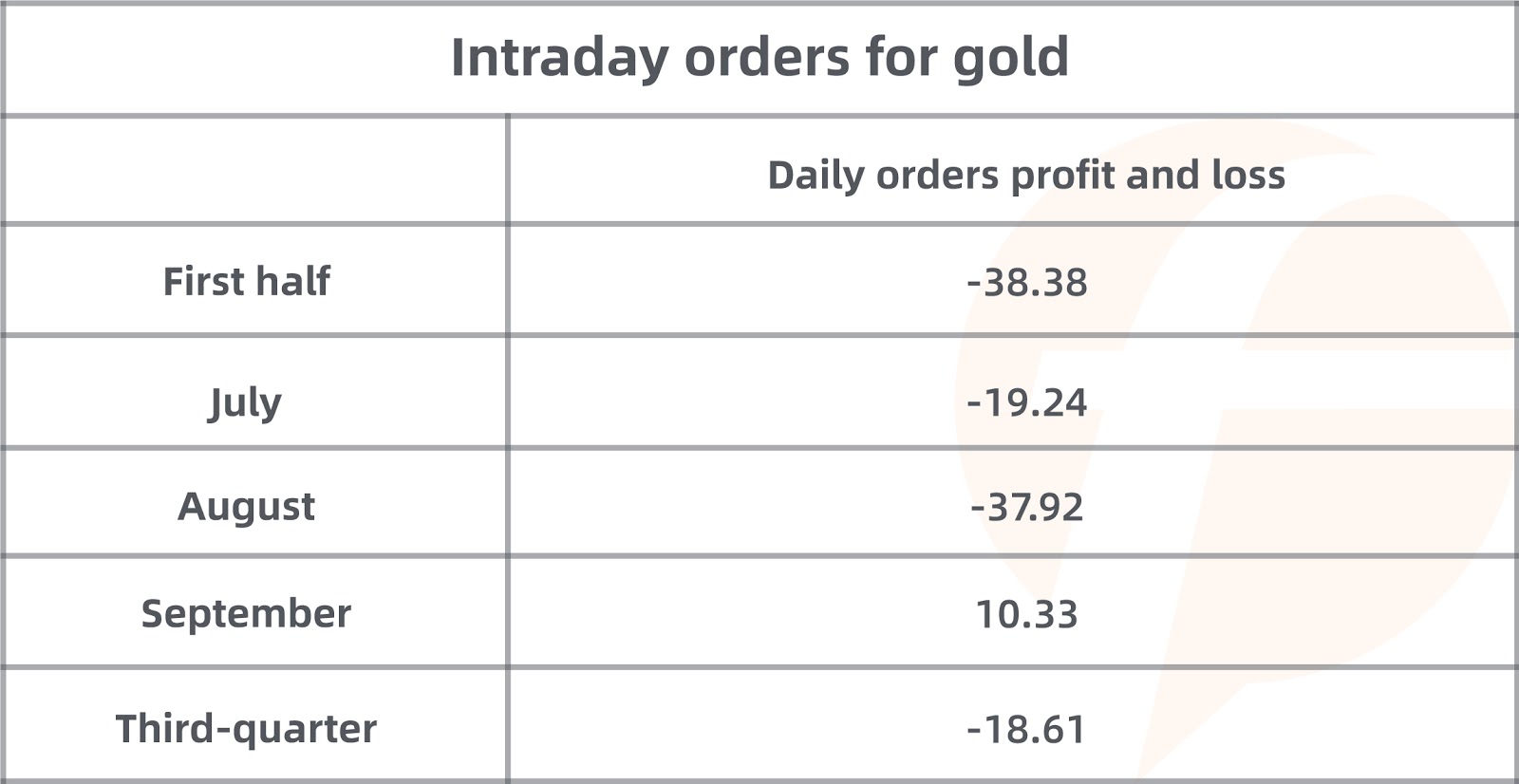

*Average single-hand profit and loss = the sum of the profit and loss of traders' gold symbols / the total number of trading lots of traders' gold symbols

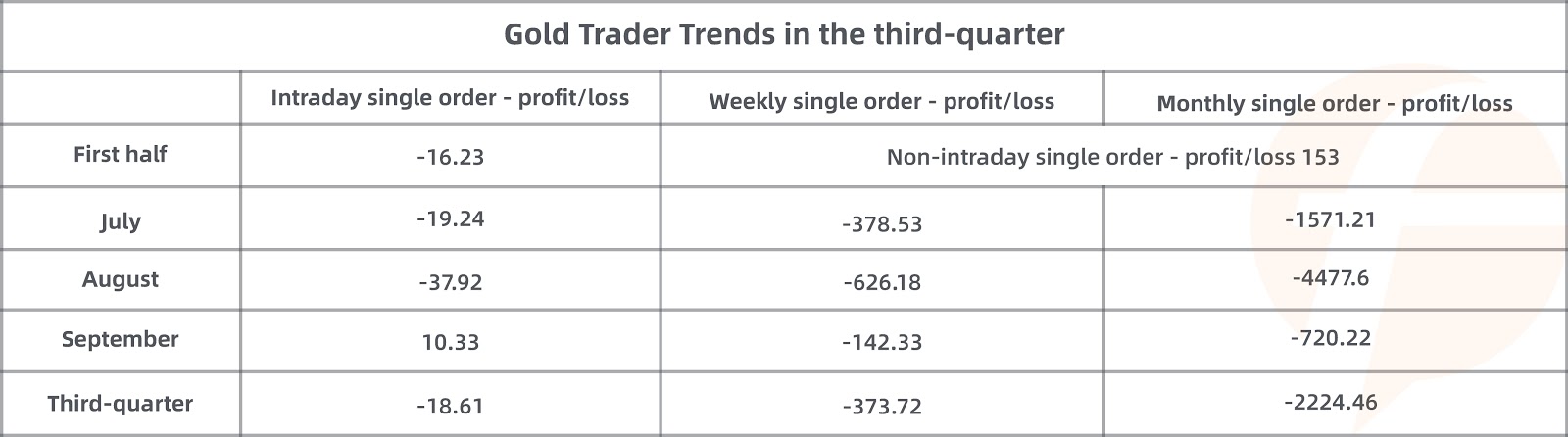

Given that the gold symbol is the most actively traded asset to best represent the characteristics of an entire group, we will analyse the traders of the gold symbol solely. Compared with the second quarter, the gold traders on FOLLOWME Trading Community have made significant progress in the third quarter, with a noticeable drop in the trader’s average single-hand loss as shown in the table above.

On the two main issues mentioned above, let's further analyse the transaction situation in the third quarter and find out the latest outcome.

Keen to trade short-term, but overlook the cost

The trading habits of gold traders in the third quarter are still keen on short-term, but they overlook the hidden cost.

We mentioned in the first half of 2020 report that the gold traders achieved good results in short-term trading. However, they often closed orders with low profits, unable to cover the cost of handling fees, which ultimately leads to account losses.

So how did the short-term gold traders perform in the third quarter?

The performance of traders as a whole in the third quarter was not much different from the previous ones. Taking the basis of $25 (0.25 pip difference in gold) for each lot to open a position as an example, most of the time, traders were on track with the market sentiment yet made a loss due to the cost. Or, it is also possible in some cases that when a trading order is profitable, the trader wants to avoid a loss and ultimately close the order near the break-even line.

Overall, the trading situation of traders on the gold’s intraday orders has not changed from the first half of the year.

Next, let's look at the second issue we mentioned in the first half of the article.

- Risk control strategy is not in place - long-term becomes the only option

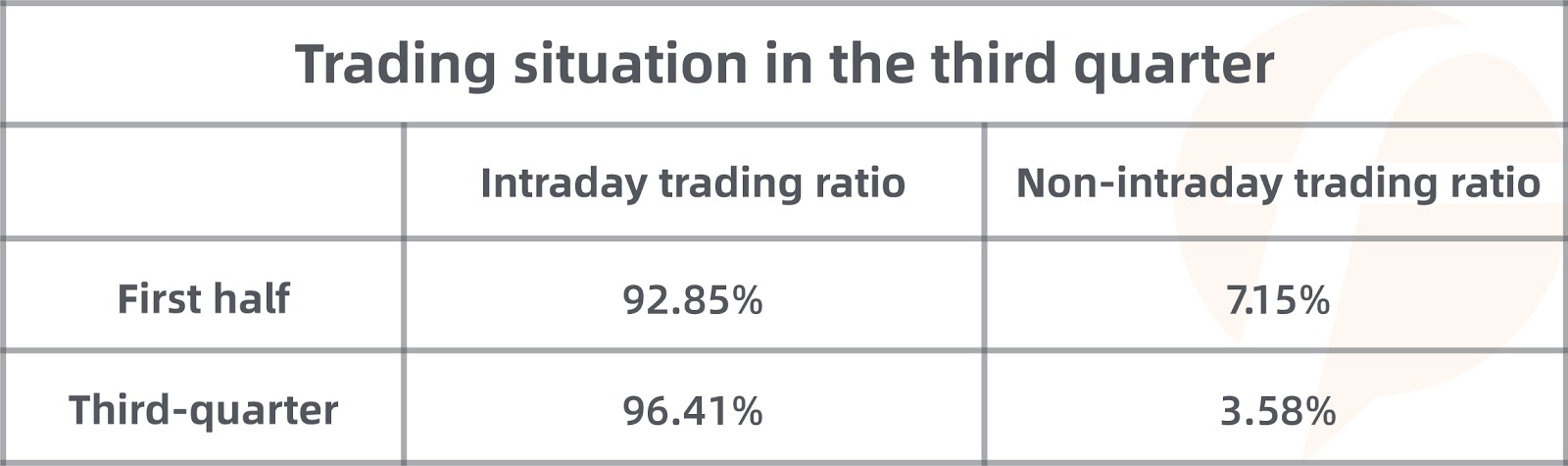

The data above is more shocking than the first half of 2020 report. Non-intraday orders only accounted for 3.58% of the total orders in the third quarter. However, the loss from non-intraday orders accounted for 50% of the total loss in the third quarter.

Most of the non-intraday orders of gold traders were probably dragged by the market sentiment, which pushed them into making bigger orders subsequently. Hence, the trend in the third quarter tells us that the problem of inadequate risk control strategy continues to exist and these traders had to opt for long-term trading to recuperate.

- September performance details

If you have been paying attention, you might notice that the trading data of gold traders in September was better than the other two months. Are these gold traders progressing? To answer this specific question, we need to analyse every single detail and compare the actual market trends to get answers.

The picture above shows the trend of gold in the third quarter. The green box = July; yellow box = August; red box = September.

Assuming a trader who is keen on short-term gold trading (intraday), but will place orders from time to time. What can we see by using this trading method over these three months?

First of all, the July market may not be an attractive period for certain traders. Although the narrow range at the beginning of the month can play very well in the short-term intraday trading, the market sentiment that followed may have trapped many. But fortunately, the market pace in July is not intense so, even if you were stuck, there were still rooms to leave.

The market trend in August was the opposite. There were several consecutive violent unilateral movements throughout the month. Many were caught off guard and struck by a large loss margin. Those who can leave did so as soon as they stopped registering a loss.

September was better with a long upper and lower shadow lines, relatively smaller amplitude, making it a haven for short-term intraday traders. Even if you were trapped, you can still recuperate most of the time except the end of the month when there was a wave of trend. Even so, most people were already preparing to celebrate the festivals and reasonably saw a decrease in the transaction volume. As a result, this sums up the main reason behind the differences in the statistical performance of these three months.

- Summary:

In the final analysis, the main reason for the loss made in the third quarter is the same as summarised in the first half of 2020 report: Most traders have yet to establish a stable trading system of their own. Please remember that irrational loss-stopping and the lack of loss-stopping are just as equally undesirable.

As cited in the first half of 2020 report: "To improve trading performance, you cannot simply improve risk control or increase single-handed profitability, which is not comprehensive. Increasing single-handed profitability alone may lead to a decrease in the winning rate of traders whilst relying on risk control strategy only may also lead to early liquidation of profitable orders. Regardless whether the traders are using an EA or manual trading, they should establish their own trading system that works for them first. This system should at least include entry and exit rules, position rules, and risk control rules. With this comprehensive system, we can always optimise and improve our trading skills over time."

5. Traders’ Interview

It was said that forex trading is a lonely practice, and behind every trader is a thrilling story. In the third quarter of 2020, the FOLLOWME trading community interviewed 12 traders. They come from all walks of life with very different life experiences, but they all started foreign exchange trading to leverage on one thing: opportunity.

The longest period of trading in these traders is 14 years, and the shortest - four years. Some are full-time traders who monitor the market every second they can and review the market every week. Some only take trading as an investment and hand it over to EA. Some are more conservative in style, trade steadily, never take risks and only pursue stable profitability. The rest enters the market in an unexpected manner, and tends to trade against the trend with short-term heavy positions.

This quarter we have selected two featured articles from our 12 interviews with traders, to showcase our community made up of profiles from various perspectives.

- Interview with @冷岩作手 forex is not a shortcut of getting rich, but a way of managing money

Q:How long have you been trading? How did you come into the forex trading industry?

It's been almost 10 years. At first, I wanted to study financial management, but then I studied stock market in college. I traded warrants before I even learned about the existence of T+0. Soon after, Changhong warrants expired and that was the end of that. After being introduced by an instructor, I came into contact with gold and forex.

Q:When doing transactions, do you often exchange trading experience with your peers?

I think mature traders are very exclusive. The method is not important. It is a good method to control the profit and risk. My communication with PTA friends is also mainly focusing on the general directions, instead of specific transactions.

Q:Do you think there is a relation between a profit or loss in forex trading and personality? Are people with certain traits tend to focus on profits, while others with different traits will find it difficult to do so?

There is definitely a correlation there. Those who are calculative and unwilling to keep an open mind are not suitable in trading. We should learn to embrace any loss while keeping a humble mindset towards any profit.

Q:We see that you have formulated a very strict stop loss strategy, and many people also have a certain stop loss strategy. But when it comes to certain situations signaling loss-stopping, the trend will go up instead. What is your take on this and how to overcome it?

The main reason is the fear of loss. By setting an unreasonable position, the cost of losing one order is too significant, and most people will have a hard time in accepting a defeat. There are ways to overcome this. You must set a position of every single transaction according to the loss-stopping amount, and it must be consistent. Every time you open a position, you already factor in the possibility of a loss. So when that happens, it rarely has any effect on the account, this naturally eliminates your fear of losing money.

Q:Let me give some suggestions to traders who are new to the forex market in the community. What do you want to tell them?

The most efficient trading mode is to hold on to one principle or system, instead of wanting to learn a certain method or certain strategy. First, a trader must learn how to control risks, and then learn how to make profits and optimise them. Avoid focusing on maximising profit in each trade. A perfect trading system does not exist,so what we can do is learn to tolerate the defects of the system.

- Interview @好久见 mainly in long-term trading, supplemented by short-term trading, generated a half-year profit of $32,646

Q:Many master traders have a stage of "paying tuition". Have you ever experienced the stage of "paying tuition" in the forex market?

I went through the stage of ‘paying tuition fees’, and I have been in three positions. I summed up some experience every time I liquidated a position, and I probably only found the secret to profit the year before.

Q:You are involved in both the short-term and the medium-/long-term. What do you think is the core difference between the short-term and the medium-/long-term?

The short-term analysis is mainly based on the trend chart, and the position will be heavier. The long-term analysis is mainly based on the macroeconomics, and the position will be lighter.

Q:You are mainly engaged in medium-/long-term trading. We all know that the capital drawdown of medium-/long-term trading will be slightly larger. How do you handle or control the capital drawdown?

My trading is mainly based on the long-term, supplemented by the short-term. If you do the long-term, the position may be held in a six-month to one-year cycle, and then analyze it according to my system and a macroeconomic level of the country, and then predict an acceptable retracement range. Generally, the acceptable backtest is about 30%, so I generally don’t worry too much.

Q:The unique leverage of forex trading makes the risk increase sharply. Risk control is also a link that every market participant attaches great importance to. However, you did not set a stop-profit and stop-loss when placing an order. So how do you strictly control the risk?

In the long-term, I did not set a stop loss, because the macroeconomic analysis of the size of the risk, whether there will be a flash crash, through the macro economy, some black swan events caused by flash crashes can be predicted. In the short term, I mainly look at the one-minute chart. Setting the stop-profit and stop-loss point will affect the profit of one of my operations. At the same time, I stayed up directly, or maybe stayed up all night, and I didn't sleep until the position was closed. So I didn't set this to take profit and stop loss.

Q:It is said that forex trading is a condensed life. What is the biggest insight you have experienced in your forex trading career?

The biggest insight is to stop losses in time if errors are found. When doing anything, you must first consider the risk and minimize the risk.

6. Community Advantage

FOLLOWME follow order system “COPYTRADE '' supports cross-Broker follow-up trading. Users can connect to the community as long as they have an MT4 account, and choose their preferred signal provider of interest to copy orders. The community currently covers more than 3,000 Brokers.

Community users can choose to become subscribers or traders. Subscribers can choose to subscribe to trading signals they are interested in and customise their follow-up methods, enjoy automated documentary services, and earn income. Traders can provide their trading signals in the community and earn subscription fees. To set up a subscription account, the trader must use a dealer account that has reached a certain operating life, company size, obtained regulatory qualifications and gained significant popularity among the users.

FOLLOWME Trading Community has set up servers in multiple regions and countries to ensure that it provides community users with stable account connections and millisecond-level follow order services. Even when the market fluctuates sharply, such as non-agricultural markets, we can continue to guarantee copy orders to run efficiently.

Community has multiple protection mechanisms to ensure the safety of user funds and handle abnormal orders.

- The first mechanism: Equity Protection. It allows followers to set an appropriate equity protection value according to the account situation. Once the protection value is reached, the follower will be suspended immediately and all orders will be closed to prevent further losses. Users can be notified immediately by SMS, email, and such.

- The second mechanism: abnormal monitoring. COPYTRADE will monitor the account connection status and follow order status 7x24. If the connection status is abnormal, COPYTRADE will immediately try to reconnect; if the follow-up position fails to open, COPYTRADE will have a limited number of attempts to reopen the position; if the follow-up position fails, COPYTRADE will continue to try to close the position until the closing is completed. At the same time, the risk control center will also participate in exception handling to ensure that exceptions can be handled efficiently and to ensure the safety and stability of the order to the greatest extent. In addition, when there is an abnormal situation with the order, the user will receive notifications such as text messages and emails within the first time.

- In the third quarter, the trading signal interface of FOLLOWME 5.0 version underwent a new revision, so that followers can see various data of traders more intuitively and clearly.

The Signal basic information page includes relevant information such as trader's nickname, account number, medal, rank, subscriptions, return on investment (ROI), maximum drawdown (Max DD) and subscription fee.

The main content of the trader's account statistics consists of four parts, chart, rank, subscription and order.

The Chart section conducts multi-angle and omni-directional analysis on the transaction data of the account, forming multi-dimensional charts and statistical indicators, allowing you to view the situation of the trading account more comprehensively and in detail.

The Rank section considers the trader’s risk control ability, stability, profitability and other three indicators as consideration factors on the premise of considering all the trading data and information of the trader to ensure the objectivity and scientificity of the ranking.

The Subscription section mainly displays the subscriptions of traders, the total amount following and the changes in follower’s profit.

The Order section can view the information of each trading order of the trader.

Vision: Become the most popular trading community in the world.

Mission: Make trading more easier and transparent.

Concept: Users First, Technology for Social Good

Disclaimer: The report data comes from the FOLLOWME trading community, and we strive to ensure the accuracy and accuracy of the data. The report predicts to share the latest data and information with practitioners in the industry, and to use technology to promote the sound development of the industry. It is stated that the report does not constitute any opinions or suggestions, and investment decisions need to be based on independent thinking.

For non-commercial reprints, please attribute the source to FOLLOWME. For the commercial purpose of reprint or usage of this report, please contact FOLLOWME Branding Department to obtain the copyright. Email us at info@followme.com.

Scan this QR code to download the app.

Edited 17 Nov 2020, 10:52

Disclaimer: The content above represents only the views of the author or guest. It does not represent any views or positions of FOLLOWME and does not mean that FOLLOWME agrees with its statement or description, nor does it constitute any investment advice. For all actions taken by visitors based on information provided by the FOLLOWME community, the community does not assume any form of liability unless otherwise expressly promised in writing.

FOLLOWME Trading Community Website: https://www.followme.com

Hot

-THE END-